HISTORICALLY A GOOD SIGN OF A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

It symbolizes power, good fortune, and strength and is associated with auspicious traits like intelligence, ambition and charisma. Historically linked with imperial power, Chinese emperors considered themselves descendants of dragons, emphasizing the dragon's esteemed position.

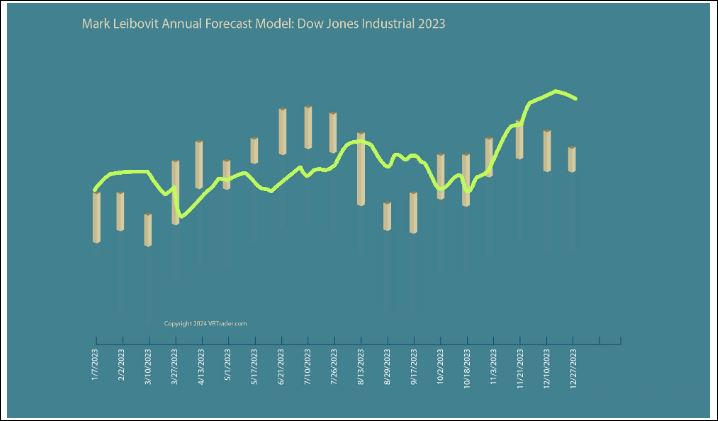

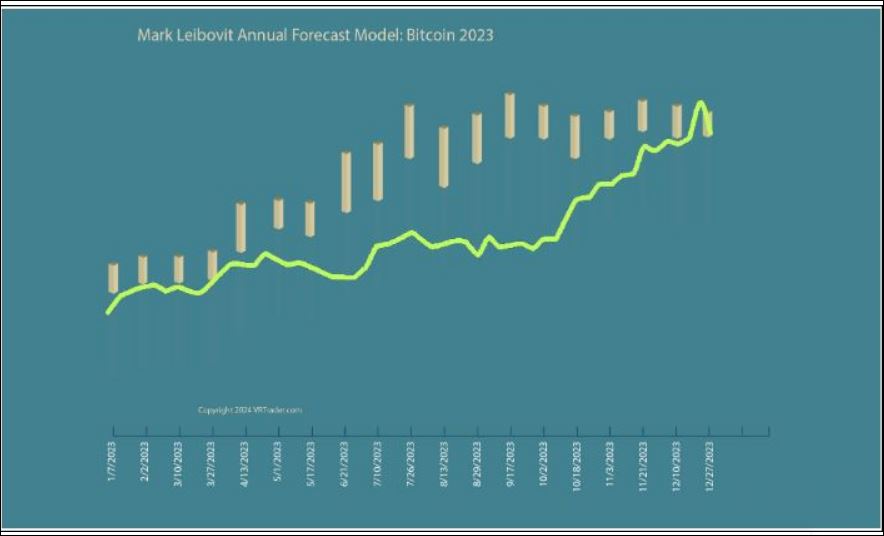

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/03/gold-bitcoin-us-dollar-mark-leibovit/

NEXT UPDATE THURSDAY EVENING

DID YOU MISS THE WEDNESDAY'S METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

Nasdaq, S&P 500 Give Back Ground But Dow Closes Higher For Third Straight Session

Following the significant rebound seen during Tuesday's session, stocks turned in a relatively lackluster performance during trading on Wednesday. The major averages spent most of the day on opposite sides of the unchanged line before closing mixed.

While the Dow inched up 37.83 points or 0.1 percent to 39,043.32, closing higher for the third consecutive session, the S&P 500 dipped 9.96 points or 0.2 percent to 5,165.31 and the Nasdaq slid 87.87 points or 0.5 percent to 16,177.77.

The pullback by the Nasdaq partly reflected weakness in the tech sector, with AI darling Nvidia (NVDA) slumping by 1.1 percent.

Overall trading activity remained somewhat subdued, however, as a lack of major U.S. economic kept some traders on the sidelines ahead of the release of several key reports in the coming days.

On Thursday, the Labor Department is scheduled to release its report on producer price inflation in the month of February, which may shed additional light on the outlook for interest rates.

Producer prices are expected to rise by 0.3 percent in February, matching the increase seen in January, while the annual rate of producer price growth is expected to accelerate to 1.1 percent from 0 .9 percent.

Reports on weekly jobless claims and retail sales are also due to be released on Thursday, with retail sales expected to rebound in February after slumping in January.

On Friday, trading may be impacted by reaction to reports on import and export prices, industrial production and consumer sentiment.

The University of Michigan's preliminary report on consumer sentiment in March may be in focus, as it includes reading on inflation expectations.

Sector News

Most of the major sectors showed only modest moves on the day, contributing to the lackluster performance by the broader markets.

Energy stocks saw considerable strength, however, with a sharp increase by the price of crude oil contributing to the strength in the sector.

With crude for April delivery spiking $2.16 to $79.72 a barrel, the NYSE Arca Oil Index surged by 2.3 percent and the Philadelphia Oil Service Index shot up by 1.9 percent.

An increase by the price of gold also contributed to considerable strength among gold stocks, as reflected by the 2.2 percent jump by the NYSE Arca Gold Bugs Index.

On the other hand, semiconductor stocks showed a significant move to the downside, dragging the Philadelphia Semiconductor Index down by 2.5 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region ended mixed once again on Wednesday. While China's Shanghai Composite Index fell by 0.4 percent and Japan's Nikkei 225 Index dipped by 0.3 percent, South Korea's Kospi climbed by 0.4 percent.

Meanwhile, European stocks moved mostly higher on the day. The French CAC 40 Index advanced by 0.6 percent and the U.K.'s FTSE 100 Index rose by 0.3 percent, although the German DAX Index closed just below the unchanged line.

In the bond market, treasuries are extending the pullback seen over the two previous sessions. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, climbed 3.7 basis points to 4.192 percent.

Looking Ahead

While the producer price inflation data is likely to be in the spotlight on Thursday, trading could also be impacted by reaction to the jobless claims and retail sales data.

US, European Union React to BRICS Rapid Growth -watcher.guru

We have been warning about the impact of BRICS for some time now. The US has addressed the progression of BRICS where it can and the likely economic fallout their advancement represents. It would seem BRICS is moving along so quickly, there will be no catching up.

by Michael Grullon

BRICSThe BRICS bloc is ready to continue its expansion in 2024. Successfully inducting multiple new nations in January, the bloc is expected to invite more countries to join sometime this year. With more countries showing interest in BRICS and its missions, the United States and the European Union are facing a new developing threat.

BRICS is advancing at a rapid pace in its de-dollarization efforts by cutting ties with the US dollar. The new members have begun settling trade in local currencies by ending dependency on the greenback. Furthermore, India, China, Russia, and the UAE have started using their respective local currencies, reducing their reliance on the US dollar.

Multiple political/economic voices in the United have shared their concerns about the future of BRICS and its impact on the United States. As BRICS continues to grow, some are sure that its growth will pose an immediate threat.

US Politician Marco Rubio shared a warning to the US recently about BRICS, saying that its growth might interfere with the ability to exert sanctions on other nations. “If current trends continue, it will become harder and harder for the United States to prevent international violence and oppression through sanctions,” Rubio wrote in a recent op-ed article/open letter.

Gold’s Got the Midas Touch Back - Daily Reckoning

by James Rickards

After two years of trading in a 20% range between $1,600 and $2,000 per ounce, gold finally broke out to the upside, closing at a new all-time high of $2,126 per ounce on March 4.

Better yet, if you're a gold investor, gold has held its ground around $2,100 per ounce since breaking that ceiling (gold's trading at around $2,187 today).

The price is volatile, but gold broke even higher on March 5 when it hit $2,140 on an intra-day basis. Before getting too euphoric, gold investors should recall that the $800 per ounce record set in January 1980 during borderline hyperinflation would be $3,200 per ounce in today’s dollars if adjusted for inflation.

That can be a splash of cold water in the face. On the other hand, it's highly encouraging. If gold is in a new bull market, $3,200 per ounce looks more like a price target than an insurmountable hurdle.

But I continually remind gold investors, whether in bullion or mining shares, not to get too euphoric when gold rallies and not to get too depressed when the dollar price retreats. Gold is still the best form of money and proves valuable to investors over time.

The bigger questions are: What are the factors driving gold higher, and will they continue the trend?

Central Banks Boost Gold Reserves to Diversify from the Dollar -Yahoo! Finance

Authored by Simon White, Bloomberg macro strategist

chartPowell might not be overly worried about inflation - with his recent comments reiterating the Federal Reserve is on track to cut rates this year - but other central banks are not so relaxed. Gold’s new high signals global central banks are likely accumulating the precious metal in an effort to diversify away from the dollar, as persistently large fiscal deficits threaten to further erode its real value and lead to more inflation.

Gold’s move in recent days has been broad as well as pronounced (as well as hinted at by low gold vol), with the precious metal making 50-year highs versus three-quarters of major DM and EM currencies. The biggest holdings of gold after jewellery are for private investment - ETFs, bars and coins - followed by central banks’ official reserve holdings.

In recent years the swing buyers have been ETFs, which hold about 2,500 tonnes of gold. But ETF holdings have been falling even as the dollar price of gold has been rising.

The dollar has been stable and real yields (which anyway have a non-linear relationship with gold) are higher over the last three months. The bulk of seasonal buying, for instance Diwali in India, is likely behind us. Further, silver has not participated in the rise. It’s therefore a reasonable supposition the official sector, i.e. central banks, has been a significant driver of gold’s recent ascent to new highs.

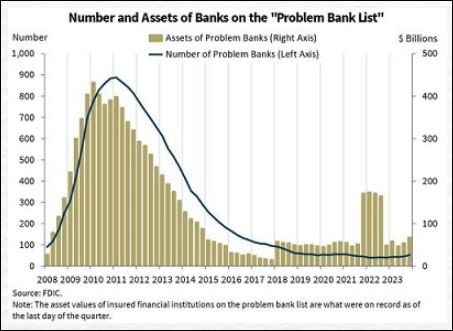

The 5 Charts The FDIC Doesn't Want You to See - Swiss America Daily News Digest Inbox

https://www.zerohedge.com/markets/these-are-5-charts-fdic-does-not-want-you-paying-attention

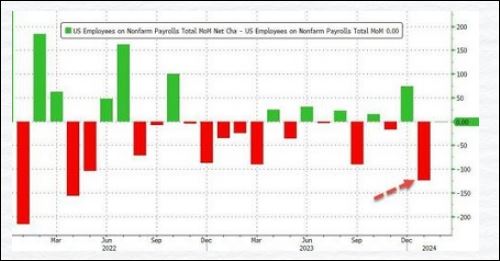

Washington's "Problem Bank List" rose again last quarter, capping off a year when US lenders struggled to cope with higher interest rates and more overdue loans for commercial buildings and credit cards.

The FDIC's confidential tally of lenders with with financial, operational or managerial weaknesses had grown by eight banks to 52, representing 1.1% of the institutions it oversees. The total assets held by those firms increased by $12.8

billion last quarter to $66.3 billion.

Although the number of firms on the FDIC's list remains relatively low compared with historical highs, it continues an increasing trend that started early last year.

Always-friendly Senator Liz Warren lambasted Fed Chair Jay Powell today, claiming that "greedy bank executives" were behind bank failures, and the Fed needs to do its job of regulating those institutions.

Powell responded by saying they've reached out to banks with high levels of uninsured deposits and high levels of office real estate debt, adding that The Fed is examining whether they are "being truthful" with themselves.

With regard to being "truthful", as we detailed previously, many of the loans on banks' books are dramatically mispriced (over-valued):

"The worry now is that such firesales will set an example for other major investors seeking a way out of the turmoil too, forcing a wholesale crash in the Manhattan real estate market which until now had managed to avoid real price

discovery."

Warren responds by exclaiming that Powell has "gone weak-kneed" on bank regulation, concluding with this shot across the bow:

"the American people need a leader at the Fed who has the courage to stand up to these banks."

Bank of America Issues Warning of a US Dollar Collapse -watcher.guru

by Vinod Dsouza

The US national debt is now growing by $1 trillion every 100 days since 2023. The uncontrolled debt could lead to a financial disaster wreaking havoc not only in the US but across the world. BRICS and other developing countries are worried that a US dollar debt could make their native economies crash. Keeping the US dollar in reserves is now seen as a threat that could undo years of financial stability.

The US dollar national debt now touched a new high of $34.4 trillion and is barely under control. Elected representatives at Capitol Hill and officials from the Federal Reserve are unable to tame the ever-growing debt.

Amid the economic turbulence, Bank of America has issued a warning about a possible US dollar collapse. Moreover, this allows BRICS to spread the de-dollarization initiative across the world.

BRICS: Growing Debt Risks Exposure of a US Dollar Collapse, Warns Bank of America

Bank of America warned in the latest piece that the US dollar and economy face a “blowout year” in 2024. The growing national debt is the main reason why the US economy could be poised to head south. “The US national debt is rising by $1 trillion every 100 days,” Michael Hartnett, Chief Strategist of Bank of America wrote.

Hartnett warned that the collapse of the US dollar is imminent if the debt grows out of control this year. “This doesn’t end well,” wrote Genevieve Roch-Decter, a former Asset Manager at the Grit Capital. Also, BRICS is now waiting for a possible US dollar decline and could advance with a new currency in the global market.

Top real estate CEO warns ‘500 or more’ banks will either fail or be consolidated over the next two years -Yahoo! Finance

The talking heads at the Fed want us to believe our banking woes are behind us, but our clients continue to share their concerns that we've only seen the beginning. More and more experts in this sector are sounding an alarm that the coming commercial real estate correction will be devastating for banks. We tend to agree.

by Will Daniel

Ever since four regional banks holding a combined $532 billion in assets—headlined by Silicon Valley Bank—failed in March 2023, regional banks have been under scrutiny from regulators. And given the commercial real estate (CRE) industry’s issues, a key focus has been on banks with the most exposure to the volatile sector.

In an upcoming white paper seen exclusively by Fortune, RXR CEO Scott Rechler described how regional banks will face a “slow-moving train wreck” as waves of commercial real estate loans mature over the next few years. Rechler has faith that many commercial real estate owners, operators, and lenders will figure out a way to overcome the challenges facing them, but he’s more skeptical about regional banks. “I think there's going to be…500 or more fewer banks in the U.S. over the next two years,” he said. “I'm not saying they're all going to fail, but they're going to be forced into consolidation if they don't fail.”

“They don't have a business model that's going to enable them to stand alone, and be competitive, and retain deposits and service customers the way that they have,” he added.

Regulators’ fears about regional banks with exposure to CRE aren’t unfounded, New York Community Bancorp (NYCB) being the prime example. Shares of NYCB have plummeted roughly 78% from their July 2023 peak due to concerns over the bank’s CRE exposure. The pain accelerated after NYCB reported a surprise fourth-quarter loss and slashed its dividend on Jan. 31, 2024, because it had to put away more money to cover its CRE holdings.

For Rechler, regional banks’ CRE exposure could even end up being a “systemic issue.”

$1 Trillion in 100 Days! -Daily Reckoning

What used to take 205 years, now takes 100 days! This sounds like an innovation in efficiency, but sadly, it's just the astounding growth rate of the US debt. Can we continue on this trajectory? It seems impossible, but when have you ever known the government to slow down spending?

by Brian Maher

How does a man descend into bankruptcy?

Gradually — then suddenly — in Mr. Hemingway’s famous telling.

The United States government has passed beyond bankruptcy’s gradual phase.

It has entered bankruptcy’s sudden phase.

Mr. Michael Hartnett, Bank of America’s chief strategist:

“The U.S. national debt is rising by $1 trillion every 100 days.”

United States debt first scaled $1 trillion 205 years after its inception. And today?

The work of 205 years presently reduces to 100 days.

$1 trillion every 100 days? Impossible — but there you have it: Debt Goes Exponential

And so today a pearl of sorrow courses down our crimson cheek… a mournful tear upon the ashes of the nation’s finances.

We fear its debt is assuming the hellacious form of a parabola.

That is, the business begins to assume an exponential aspect.

If only the nation’s gross domestic product could maintain pace with its parabolic and exponential debt.

It cannot… alas.

As gold scales all-time highs, Wall Street analysts say it has even further to go

Gold is headed higher and it's not stopping soon. As we kick off a very uncertain year, gold should shine until at least November, and likely even longer based on who is elected.

by Jenni Reid

Gold prices pushed higher Tuesday after futures pricing for the precious metal notched fresh records in the previous two sessions — with analysts seeing strength lasting at least into the second half of the year.

The gold contract for April on Monday closed above $2,100 per ounce for the first time, and was up 0.37% at $2,134.2 at 1:15 p.m. in London. Spot gold was trading 0.7% higher at $2,129, though market-watchers note that in real terms, adjusted for inflation, gold is well below past peaks.

In a Monday note, analysts at Citi described themselves as “medium-term bullion bulls,” calling a 25% probability of gold averaging a record $2,300 per ounce in the second half. Their base case remains $2,150, and they reiterated a “wildcard” call for trade reaching $3,000 over the next 12 to 16 months.

Citi describes gold as a developed market “recession hedge,” and increasingly see tailwinds from uncertainty around the U.S. election in November.

Analysts at Berenberg also noted Monday that a Donald Trump victory in the election would provide a “major positive for gold,” with further support for the safe-haven asset from volatility around the ongoing wars in Ukraine and Gaza

America on Eve of Banking Crisis, Warns Ex-IMF Official, With Hundreds of Lenders at Risk of Failure -The Daily Hodl

by Alex Richardson

A former IMF official believes the U.S. Federal Reserve has pushed America to the brink of another banking crisis.

Desmond Lachman, who was deputy director in the International Monetary Fund’s (IMF) Policy Development and Review Department, says in a new blog post for public policy think tank The American Enterprise Institute (AEI) that Fed Chair

Jerome Powell is “inviting a banking crisis.”

With banks already under pressure, Lachman says the Fed is making matters worse by keeping monetary policy tight, and liquidity thin.

The ex-IMF official says it’s a mistake that’s significantly raised the odds of a hard landing for the US economy while pushing lenders to the eve of a fresh banking crisis.

“In 2021, the Fed chose to ignore the markedly expansionary fiscal policy stance when it kept flooding the market with liquidity. The net result was a surge in inflation by June 2022 to a multi-decade high of over 9%.

Today, it seems to be making the opposite mistake of keeping monetary policy tight on the eve of a banking crisis at home and a weakening economic situation abroad. Unfortunately, this raises the risk of a hard economic landing within

the next year or so.”

Lachman warns that commercial real estate, which makes up a major portion of US banks’ loan portfolios, is a clear Achilles heel for the industry that could result in the failure of around 385 small and medium-sized banks.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]