HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

It symbolizes power, good fortune, and strength and is associated with auspicious traits like intelligence, ambition and charisma. Historically linked with imperial power, Chinese emperors considered themselves descendants of dragons, emphasizing the dragon's esteemed position.

World War III is already underway and the trigger for Civil War in the U.S. is disregard for laws is already upon us.

Georgia Needs to be Expelled from United States – with NY & Calif – NOW to save Society!

Courtesy of Martin Armstrong

The absurd decision that Fani Willis is not disqualified after meeting with the Vice President and having her lover appointed the prosecutor over Trump, who was also meeting with the Department of Justice, demonstrates that the legal system is just a political charade. A judge is supposed to be recused when a reasonable person might question their impartiality. This is all political, and the entire world knows it. The emails I get from overseas have been thoroughly disgusted at how the Biden Administration has weaponized the legal system to ensure its policies influenced by the Soros Conspiracy have waged war on the people of the United States.

The United States has lost any credibility in the eyes of the world. It is no longer the land of the free and home of the brave. The new interpretation is that the government is free to do as it likes and intimidate private enterprises to censor free speech, which they are prohibited from doing by the Constitution directly. There is no longer any question. The United States will be unable to survive this as a union. Political corruption has stooped to a new low, and when any nation has gone that far down the slope of corruption, it cannot stand.

Historians agree on one point. The reign of Commodus (180-192AD), who followed his father, Marcus Aurelius, is where the line is drawn for the Decline and Fall of the Roman Empire. He abused the law just as the Biden Administration is doing currently. Commodus ordered his sister Lucilla’s execution after a failed assassination and coup attempt when she was about 33 years old. Commodus was eventually assassinated. Like the Biden Administration, Commodus also targeted the rich and targeted anyone who had been aligned with his father, as the Biden Administration has done to Trump supporters. Edward Gibbon wrote of Commodus in his Decline & Fall of the Roman Empire that:

What followed Commodus’s death was another Civil War. The Praetorian Guard proclaimed Pertinax emperor, the son of a freed slave. He attempted to root out corruption by restoring discipline among the Praetorian Guard. They did not accept his attempt to drain the swamp, so Pertinax was assassinated by the Guard. After that, the Praetorian Guard actually auctioned off the throne to the highest bidder. Two rival bidders presented themselves – Titus Flavius Sulpicianus (father-in-law of Pertinax) and Marcus Didius Julianus. Didius’ bid was 25,000 sestertii per man, which was the highest bid, and he was duly declared Emperor. That led to such outrage that other generals marched on Rome to overthrow Julianus and the corruption that consumed Rome.

Roman Legions At War Pencil

The Year of the Five Emperors was 193AD, during which five men claimed the title of Roman emperor. Rome was plunged into civil war again after the death of Nero in 68 BC, the assassination of Caesar in 44 BC, and Caesar’s crossing of the Rubicon to drain the swamp in the Roman Senate in 49 BC.

Will History Repeat Again?

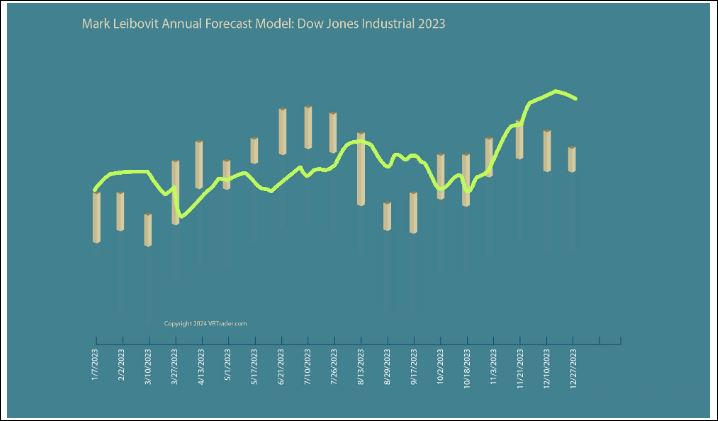

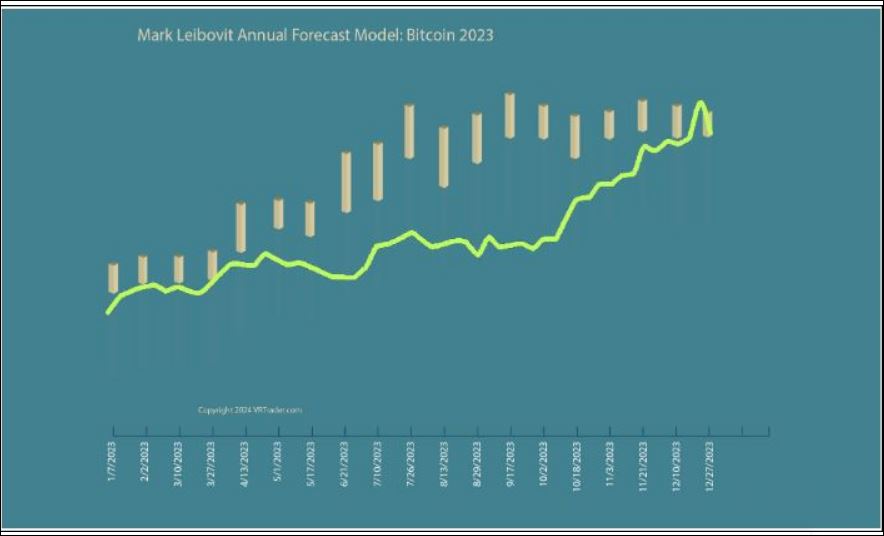

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/03/cannabis-finally-getting-a-boost-in-the-us-mark-leibovit/

DID YOU MISS LAST WEDNESDAY'S METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

U.S. Stocks Close Mixed On The Day But Sharply Higher For The Week

After trending higher over the past several sessions, stocks turned in a relatively lackluster performance during trading on Friday. The major averages fluctuated over the course of the session before eventually ending the day mixed.

While the Nasdaq inched up 26.98 points or 0.2 percent to a new record closing high of 16,428.82, the S&P 500 edged down 7.35 points or 0.1 percent to 5,234.18 and the Dow slid 305.47 points or 0.8 percent to 39,475.90.

Despite the mixed performance on the day, the major averages all moved sharply higher for the week. The Nasdaq spiked by 2.9 percent, the S&P 500 surged by 2.3 percent and the Dow jumped by 2.0 percent.

Profit taking contributed to modest weakness in early trading, with some traders looking to cash in on the recent strength in the markets.

Selling pressure remained relatively subdued, however, as traders remain optimistic about the outlook for interest rates following the Federal Reserve's monetary policy announcement earlier in the week.

While the timing of the first rate remains somewhat uncertain the chances of a quarter point rate cut in June have rebounded to 66.5 percent, according to CME Group's FedWatch Tool.

Nvidia (NVDA) helped lead a subsequent rebound by the tech-heavy Nasdaq, with the chipmaker surging by 3.1 percent.

The AI darling, which has recently been a key driver of trading on Wall Street, ended the day at a record closing high.

Shares of FedEx (FDX) also spiked by 7.4 percent after the delivery giant reported fiscal third quarter results that beat expectations and announced a new $5 billion share repurchase program.

Meanwhile, shares of Lululemon (LULU) plunged by 15.9 percent after the athletic apparel retailer reported better than expected fiscal fourth quarter results but provided disappointing guidance.

Athletic footwear and apparel giant Nike (NKE) also tumbled by 6.9 percent after reporting fiscal third quarter earnings and revenues that exceeded estimates but slowing growth in China.

Sector News

Most of the major sectors showed only modest moves on the day, but financial stocks saw considerable weakness after moving sharply higher over the two previous sessions.

Reflecting the weakness in the sector, the NYSE Arca Broker/Dealer Index slid by 1.7 percent and the KBW Bank Index fell by 1.5 percent.

Notable weakness was also visible among telecom stocks, as reflected by the 1.5 percent loss posted by the NYSE Arca North American Telecom Index.

Gold, commercial real estate and airline stocks also moved to the downside on the day, although selling pressure was relatively subdued.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Friday. Japan's Nikkei 225 Index crept up by 0.2 percent, while China's Shanghai Composite Index slumped by 1.0 percent and Hong Kong's Hang Seng Index plunged by 2.2 percent.

The major European markets also finished the day mixed. While the French CAC 40 Index fell by 0.3percent, the German DAX Index inched up by 0.2 percent and the U.K.'s FTSE 100 Index climbed by 0.6 percent.

In the bond market, treasuries showed a strong move to the upside after ending the previous session roughly flat. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, slid 5.3 basis points to 4.218 percent.

Looking Ahead

Next week's trading may be impacted by reaction to reports on new home sales, durable goods orders, consumer confidence and pending home sales.

However, a report on personal income and spending that includes readings on inflation said to be preferred by the Fed will be released when the markets are closed for Good Friday.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]