HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

It symbolizes power, good fortune, and strength and is associated with auspicious traits like intelligence, ambition and charisma. Historically linked with imperial power, Chinese emperors considered themselves descendants of dragons, emphasizing the dragon's esteemed position.

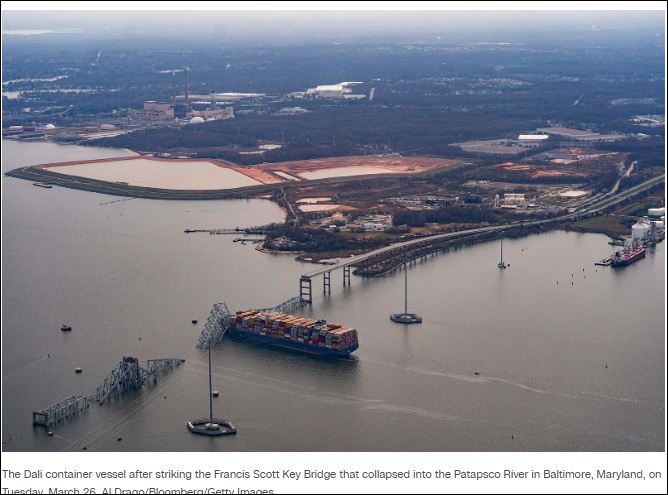

World War III is already underway and the trigger for Civil War in the U.S. is disregard for laws is already upon us. And, now we have a cargo ship slamming into a Baltimore bridge. A likely economic terrorist event! Government officials predictably minimized the event and if left unmonitored would likely try to convince us it never really happened.

Even if the channel is cleared, the ground traffic congestion in the area is likely to become very bad with the loss of the bridge. No one knows how long it would take to reconstruct a bridge across the Patapsco River. Given current concerns over the environmental impact of large marine construction projects and general bureaucratic hesitancy to authorize significant infrastructure projects, it is likely to take far longer than it did back in the 1970s, when the bridge was originally built. Bidding to work on that bridge began in 1970 after several years of planning. Work began in 1972 and it was not completed until 1977.

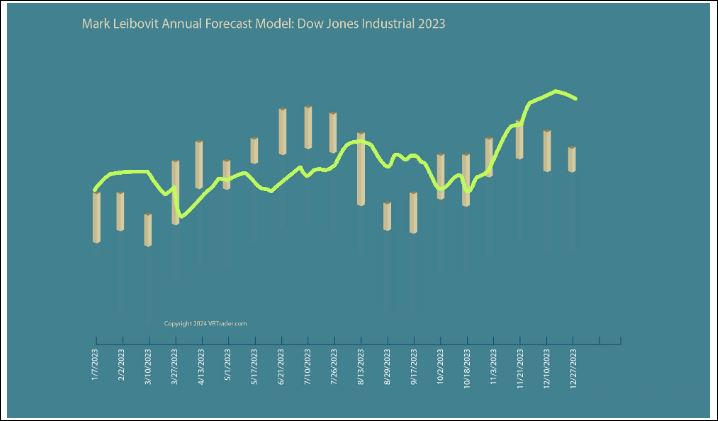

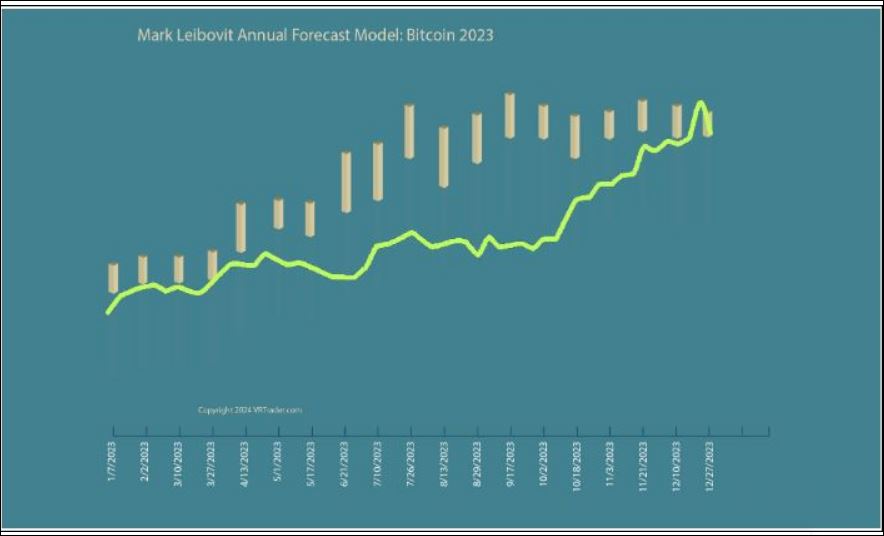

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

TODAY'S HOWE STREET INTERVIEW WILL BE POSTED WHEN AVAILABLE - HOPEFULLY BEFORE THE OPEN ON THURSDAY.

Month End window dressing started

Just when the market looks like it will break down, the money starts flowing in. Feels like the Plunge Protection team with the velocity of the rise.

After the close, Chris Waller from the Fed were released. He basically said, his view is there is no rush to cut rates. Overnight, the S&P 500 futures and Nasdaq 100 Futures are down a decent amount. We'll see if there is follow through tomorrow.

GENERAL NEWS:

Late-Day Surge Contributes To Higher Close On Wall Street

Stocks fluctuated over the course of the trading session on Wednesday but managed to end the day mostly higher thanks to a late-day surge. With the upward move, the Dow and the S&P 500 snapped three-day losing streaks.

The major averages all moved to the upside, with the Dow posting a standout gain. While the Dow jumped 477.75 points or 1.2 percent to 39,760.08, the S&P 500 advanced 44.91 points or 0.9 percent to 5,248.49 and the Nasdaq climbed 83.82 points or 0.5 percent to 16,399.52.

The strength on Wall Street came as traders once again looked to pick up stocks at somewhat reduced levels after early buying interest faded over the course of Tuesday's session.

The major averages spent much of Tuesday's session in positive territory before coming under pressure in the final hour of trading.

A decrease by treasury yields may also have contributed to the strength in the markets amid ongoing optimism about the outlook for interest rates following the Federal Reserve's monetary policy announcement last week.

While the Fed left interest rates unchanged, as widely expected, officials maintained their forecast for three rate cuts this year.

Following the Fed announcement, the chances of a 25 basis point rate cut in June have rebounded to 63.5 percent, according to CME Group's FedWatch Tool.

Trading activity remained relatively subdued, however, with a lack of major U.S. economic data keeping some traders on the sidelines.

Traders may also have been reluctant to make significant moves ahead of the release of reports on weekly jobless claims, Chicago business activity and pending home sales on Thursday.

A report on personal income and spending that includes readings on inflation said to be preferred by the Federal Reserve is also due to be released while the markets are closed on Good Friday.

The holiday will also see Fed Chair Jerome Powell participate in a moderated discussion before the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference.

Sector News

Gold stocks showed a substantial move to the upside on the day, resulting in a 3.7 percent surge by the NYSE Arca Gold Bugs Index. With the gain, the index reached a nearly three-month closing high.

The rally by gold stocks came amid an increase by the price of the precious metal, with gold for June delivery climbing $13.50 to $2,212.70 an ounce.

Interest rate-sensitive utilities and commercial real estate stocks also saw considerable strength, driving the Dow Jones Utility Average and the Dow Jones U.S. Real Estate Index up by 2.7 percent and 2.3 percent, respectively.

Airline, banking and steel stocks also showed strong moves to the upside as the day progressed, moving higher along with most of the other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance on Wednesday. Japan's Nikkei 225 Index jumped by 0.9 percent, while China's Shanghai Composite Index and Hong Kong's Hang Seng Index slumped by 1.3 percent and 1.4 percent, respectively.

Meanwhile, European stocks moved mostly higher on the day. While the German DAX Index climbed by 0.5 percent, the French CAC 40 Index rose by 0.3 percent and the U.K.'s FTSE 100 Index closed just above the unchanged line.

In the bond market, treasuries climbed firmly into positive territory over the course of the session. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, fell by 3.8 basis points to 4.196 percent.

Looking Ahead

Trading on Thursday may be impacted by reaction to reports on weekly jobless claims, Chicago business activity and pending home sales.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]