https://www.howestreet.com/2024/05/us-marijuana-stocks-going-sky-high-mark-leibovit/

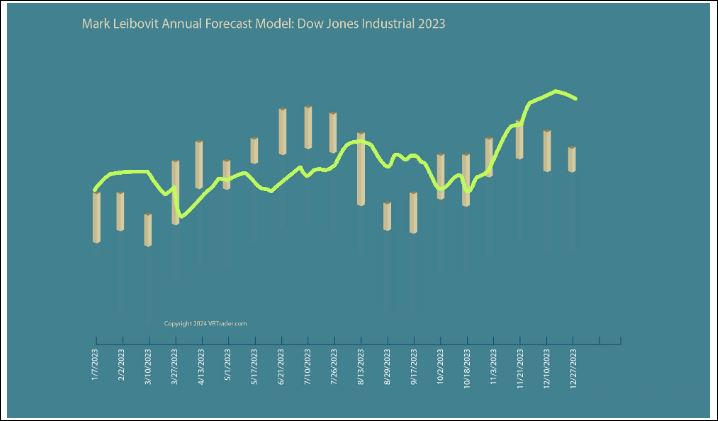

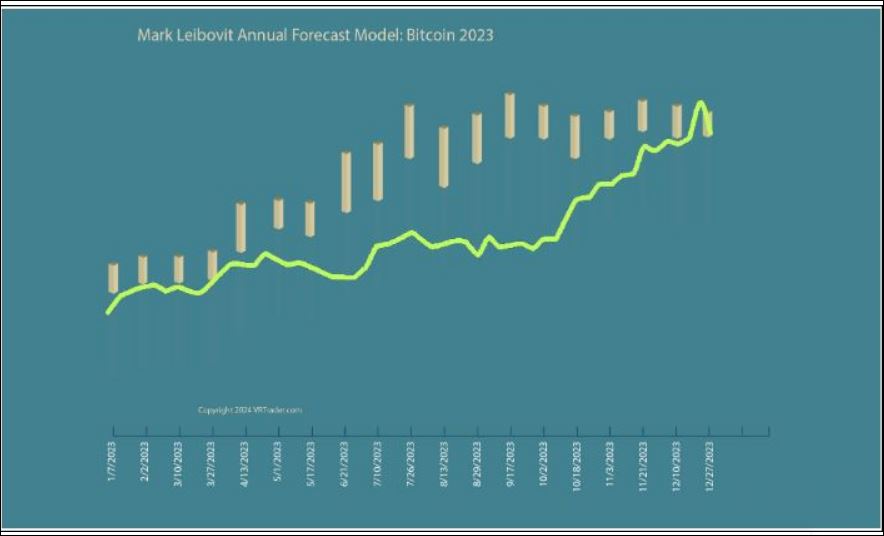

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada

U.S. Stocks Close Little Changed But Dow Extends Winning Streak

Stocks saw modest strength throughout much of the trading session on Tuesday but gave back ground in afternoon trading to end the day little changed. The Dow still managed to close higher for the fifth consecutive session, reaching its best closing level in a month.

The major averages ended the day narrowly mixed. While the Nasdaq edged down 16.69 points or 0.1 percent to 16,332.56, the Dow crept up 31.99 points or 0.1 percent to 38,884.26 and the S&P 500 inched up 6.96 points or 0.1 percent to 5,187.70.

The modest strength seen for most of the stock came as stocks continued to benefit from renewed optimism about the outlook for interest rates.

Relatively dovish comments from Federal Reserve Chair Jerome Powell combined with weaker-than-expected job growth in April have largely eliminated short-lived concerns the Fed might actually consider raising rates.

Investors have instead grown increasingly confident about a rate cut in the coming months, with the chances rates will be lower by September now at 89.1 percent, according to CME Group's FedWatch Tool.

However, buying interest waned in afternoon trading after Minneapolis Federal Reserve President Neel Kashkari suggested interest rates may need to remain at current levels for an "extended period."

"I would need to see multiple positive inflation readings suggesting that the disinflation process is on track" before cutting rates, Kashkari said before the Milken Institute 2024 Global Conference.

Kashkari also said he could not rule out the Fed once again raising rates, calling the bar for hiking rates "quite high" but "not infinite."

Among individual stocks, shares of Disney (DIS) fell sharply even though the entertainment giant reported better than expected fiscal third quarter earnings.

Sector News

Most of the major sectors ended the day showing only modest moves, contributing to the lackluster close by the broader markets.

Airline stocks showed a substantial move to the downside, however, with the NYSE Arca Airline Index tumbling by 2.7 percent.

Considerable weakness also emerged among computer hardware stocks, as reflected by the 1.1 percent loss posted by the NYSE Arca Computer Hardware Index.

On the other hand, utilities stocks turned in a strong performance on the day, driving the Dow Jones Utility Average up by 1.3 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher during trading on Tuesday. Japan's Nikkei 225 Index jumped by 1.6 percent and South Korea's Kospi surged by 2.2 percent, while China's Shanghai Composite Index crept up by 0.2 percent.

The major European markets have also moved to the upside on the day. While the German DAX Index shot up by 1.4 percent, the U.K.'s FTSE 100 Index jumped by 1.2 percent and the French CAC 40 Index advanced by 1.0 percent.

In the bond market, treasuries moved modestly higher, extending the upward trend seen over the past several sessions. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, dipped 2.6 basis points to 4.463 percent.

Looking Ahead

Trading on Wednesday may be impacted by reaction to the latest earnings news, with several well known companies due to report their quarterly results.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

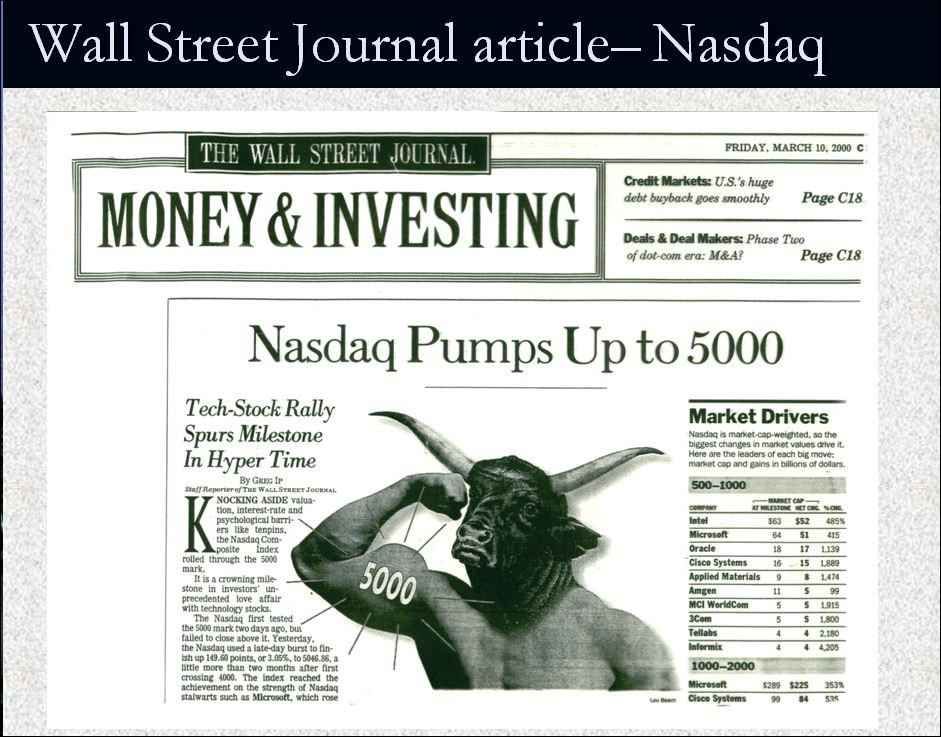

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.