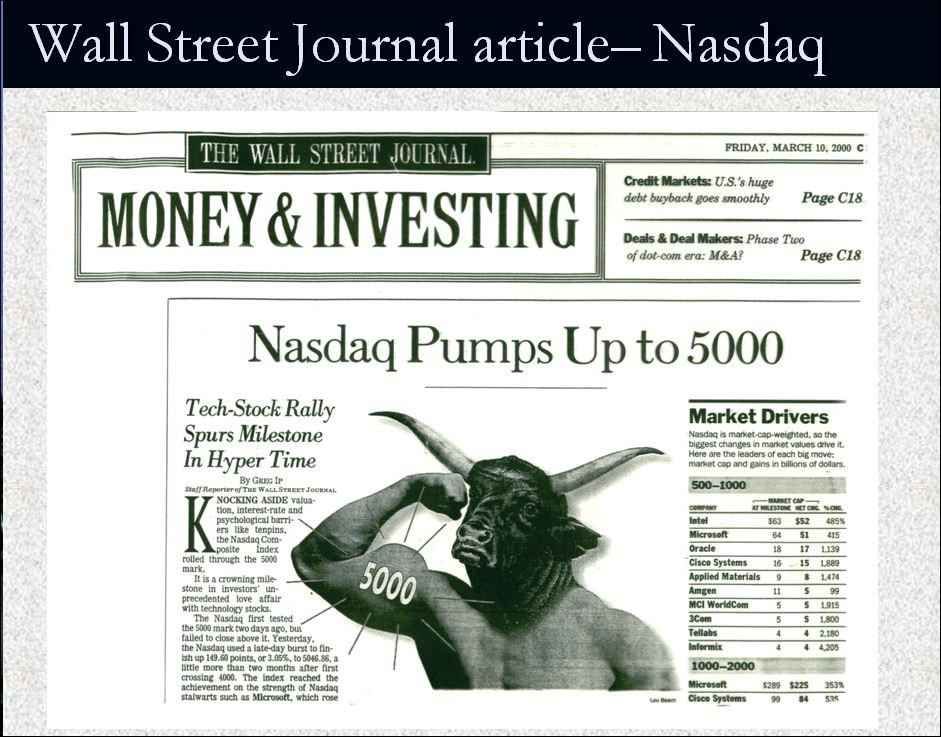

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

I CALL CORRECTLY CALLED A BULL TRAP. WHERE IS CNBC, FOX NEWS, THE WALL STREET JOURNAL ACKNOWLEDGING MY CALL?

WHAT ABOUT MY CALL FOR BLACK SWANS. WE'VE SEEN A FEW. ARE MORE BLACK SWANS ARE UNDERWAY ? - CAN YOU NAME THE ONES WE'VE JUST RECENTLY EXPERIENCED? CAN YOU GUESS WHAT COULD BE COMING? DO YOU KNOW WORLD WAR III IS WELL UNDER WAY? WHAT ABOUT THE CIVIL WAR THAT HAS BEGUN? ALL FINANCIAL MEDIA CAN TALK ABOUT IS THE FED AND CONCOCTED EARNINGS REPORTS.

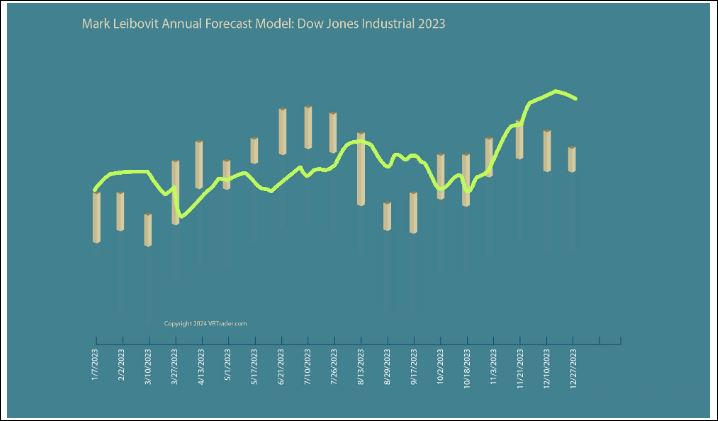

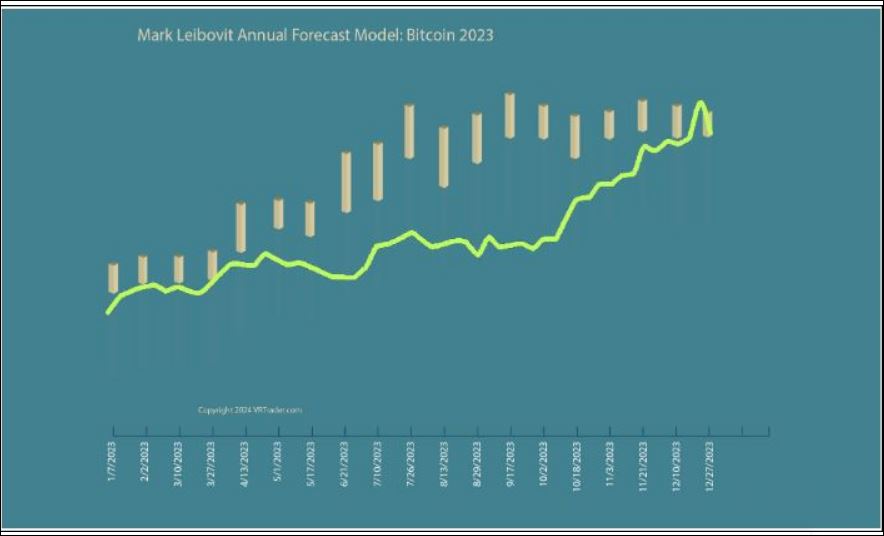

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/big-reversal-patterns-following-profit-reports-mark-leibovit/

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada.

U.S. Stocks Climb Well Off Worst Levels But Close Mostly Lower

After moving sharply lower early in the session, stocks regained ground over the course of the trading day on Thursday but remained mostly lower. The major averages all finished the day in negative territory after ending Wednesday's trading narrowly mixed.

The Dow slumped 375.12 points or 1.0 percent to 38,085.80 after plunging by more than 700 points in early trading. The Nasdaq slid 100.99 points or 0.6 percent to 15,611.76 and the S&P 500 fell 23.21 points or 0.5 percent at 5,048.42.

A negative reaction to earnings news from Meta Platforms (META) contributed to the early sell-off on Wall Street, with the Facebook parent plunging by 10.6 percent.

Meta Platforms reported first quarter results that beat estimates on both the top and bottom lines but provided disappointing second quarter revenue guidance.

Tech giant IBM Corp. (IBM) also dove by 8.3 after reporting weaker than expected first quarter revenues. IBM also announced a deal to acquire HashiCorp (HCP) for $35 per share in cash, representing an enterprise value of $6.4 billion.

On the other hand, fellow Dow component Merck (MRK) jumped by 2.9 perent after reporting first quarter results that exceeded analyst estimates.

The early sell-off on Wall Street also came after Commerce Department released a report showing the U.S. economy grew by much less than expected in the first quarter of 2024.

The Commerce Department said gross domestic product increased by 1.6 percent in the first quarter after surging by 3.4 percent in the fourth quarter of 2023. Economists had expected GDP to jump by 2.5 percent.

Meanwhile, the Commerce Department said the personal consumption expenditures price index surged 3.4 percent in the first quarter after advancing by 1.8 percent in the fourth quarter.

Excluding food and energy prices, the PCE price index spiked 3.7 percent in the first quarter after jumping by 2.0 percent in the fourth quarter.

"The Fed wants to see inflation start coming down in a persistent manner, but the market wants to see economic growth and corporate profits increasing, so if neither are headed in the right direction then that's going to be bad news for markets," said Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance.

Selling pressure waned over the course of the session, however, inspiring some traders to pick up stocks at relatively reduced levels.

Sector News

Despite the recovery attempt by the broader markets, telecom stocks continued to see substantial weakness on the day, with the NYSE Arca North American Telecom Index plunging by 2.7 percent.

Significant weakness also remained visible among software stocks, as reflected by the 1.8 percent loss posted by the Dow Jones U.S. Software Index.

Biotechnology, banking stocks and networking stocks also continued to see considerable weakness, although selling pressure waned from earlier in the session.

Meanwhile, gold stocks moved sharply higher on the day, resulting in a 4.2 percent spike by the NYSE Arca Gold Bugs Index.

Notable strength also emerged among semiconductor stocks, driving the Philadelphia Semiconductor Index up by 2.0 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Thursday. Japan's Nikkei 225 Index plunged by 2.2 percent, while Hong Kong's Hang Seng Index climbed by 0.5 percent.

The major European markets also ended the day mixed. While the U.K.'s FTSE 100 Index rose by 0.5 percent, the French CAC 40 Index slid by 0.9 percent and the German DAX Index slumped by 1.0 percent.

In the bond market, treasuries extended the downward move seen in the previous session. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, climbed 5.4 basis points to a nearly six-month closing high of 4.706 percent.

Looking Ahead

Trading on Friday is likely to be driven by reaction to the Commerce Department's report on personal income and spending, which includes readings on inflation said to be preferred by the Federal Reserve.

On the earnings front, Google parent Alphabet (GOOGL), Intel (INTC) and Microsoft (MSFT) are among the companies releasing their quarterly results after the close of today's trading.

Energy giants Chevron (CVX) and Exxon Mobil (XOM) are also among the companies due to report their results before the start of trading on Friday.

The Significance of the Month of April

Courtesy Bill Koenig (watch.org)

· Major wars began in the U.S. in this time frame.

· Major domestic terror events occurred numerous times on April 19.

· Mohammed and Hitler were both born on April 20.

· From 2006 to 2013, and once again in 2014 (and now again in 2024), there were major news items about Iran in April.

The Natural Year

· The sun governs our seasons, which are measured by the solstices and equinoxes. By many accounts, the natural year begins with the vernal equinox on March 20/21. This has been true in agrarian (agriculture/ farming-based) societies for thousands of years. It has also been true in civilizations that worshipped the sun (and established their calendars accordingly).

· As such, it starts the clock on the “opening range” of each natural year.

· If one were to begin a calendar on the vernal equinox (start of spring), the first month of that year would end on April 19/20. It is when the northern half of the earth transitions from seasonal “death” to “life.” In the old days, it was also when “kings went off to war.” (See the biblical account of when David chose not to go off.)

· Anyone who suffers from seasonal affective disorder (SAD) could certainly attest to the psychological aspects of longer days and more sunlight when the shroud of depression lifts and the rays of hope come flooding back into their lives.

· This period — from March 20/21 to April 19/20 — marks a very important transition period, linked to various means of measuring time with physical (natural), celestial (astronomy), metaphysical (astrology) and supernatural (Jewish and Christian commemorations) implications.

· April 19/20 acts like a deadline for determining what to expect in the coming (natural) year. It is a time to watch each year for signs of “change.”

———

Date of infamy for America — April 19 and the days around it

· This “natural year opening range” has diverse — and, seemingly, contradictory —implications. As just explained, it is a time when much of nature comes back to life.

· Paradoxically, it is when man often incites war (and the end of many lives). Nowhere has this remained more constant than in the histories of America and Israel.

· I have explained this concept many times before, but it is also the single most requested compilation of analysis from readers.

· In short, Eric Hadik has termed the date of April 19 (sometimes extending to the days surrounding it) as the “date of infamy” for America.

· Historically, many events that occurred during April 19-20 set the stage for the rest of the year …

———

The following are just a few of the events that have occurred on this date and have impacted/governed America's destiny … beginning with our independence (and incorporating almost every major, decisive war in our history):

· Start of Revolutionary War—April 19, 1775

· Battle of San Jacinto/end of Texas Revolution—April 19-21, 1836

· Start of Mexican-American War—April 25, 1846

· Start of Civil War—April 12, 1861

· Start of Spanish-American War—April 26, 1898

· President Franklin D. Roosevelt announces U.S. will leave gold standard—April 19, 1933

· Bay of Pigs invasion failure—April 17-19, 1961

· End of Vietnam War—April 30, 1975

· Operation Praying Mantis was on April 18, 1988. It was an attack by U.S. naval forces in retaliation for the Iranian mining of the Persian Gulf and the subsequent damage to an American warship. This battle was the largest of five major U.S. surface engagements since the Second World War.

———

The April 19/20 date has pinpointed many events of great ‘civil unrest’ and/or domestic terrorism in the U.S. They include:

· ATF raid on Covenant of the Sword and the Arm of the Lord (CSA)—April 19-21, 1985 (linked to the Oklahoma City bombing a decade later)

· Explosion on the USS Iowa (speculated to be an act of sabotage/suicide, but never proven)—April 19, 1989

· Waco/Branch Davidian raid by FBI/ATF—April 19, 1993

· Oklahoma City Bombing—April 19, 1995

· Columbine High School massacre—April 20, 1999

Additional events:

· Anti-Jewish riots break out in Palestine—April 19, 1936

· USSR performs nuclear test at Semipalitinsk, Eastern Kazakhstan, USSR—April 19, 1985

· Benedict XVI, Cardinal Joseph Ratzinger, becomes the 265th pope—April 19, 2005

· Massive BP Petroleum oil spill in the Gulf of Mexico, began on April 20, 2010

The historical date of infamy for Israel and her enemies – April 20/21

This date has also had a dramatic impact on Israel and Jews. In the last 2,000 years, Jews have had many enemies and many antagonists; but three, in particular, stand out:

· Birth of Rome/Roman Empire

· Islam/Mohammad

· Nazi Germany/Hitler

What do they have in common? They were all born on April 20/21.

· The birth of Rome (by Romulus) is dated as April 21, 753 B.C.

· The birth of Mohammad is dated as April 20, 571 A.D.

· The birth of Adolph Hitler was April 20, 1889.

Additional:

· Israel faced the Great Arab Revolt of April 19, 1936.

· The birth of Iranian Supreme Leader Ali Khamenei on April 19, 1939.

· The Warsaw Ghetto Uprising began April 19, 1943.

· The ascension of Gamal Abdel Nasser in Egypt on April 18, 1954. Nasser was Israel’s lead antagonist for almost two decades. He was responsible for three wars with Israel from 1956–1970. He was also responsible for the first United Arab Republic—in 1958–1961, a concept that could reach a more cohesive realization in the coming years.

To say the least, this has been a very significant period of time for centuries.

The President's Working Group on Financial Markets

known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]