News & Updates

MARK LEIBOVIT - HOWE STREET 'THIS WEEK IN MONEY' PODCAST JUST POSTED - PLUS MORE ON THE SUN AND THE FED

https://www.howestreet.com/2024/05/gold-oil-dow-real-estate-mortgage-rates-evs-mark-leibovit-hilliard-macbeth-ross-clark-this-week-in-money/

Not new, but got to watch this clip regarding the FED and printing money

https://tinyurl.com/46nj8bsj

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - MONDAY - MAY 13, 2024

The United States is not yet the closest it has ever been to default, but that may soon change. The secretary of the Treasury has indicated that it is unlikely the federal government will have sufficient cash or borrowing authority to pay all anticipated obligations due on June 1

CORAL MASS EJECTIONS - CMEs

https://www.express.co.uk/news/world/1897668/south-china-sea-usa-china-tensions-latest

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

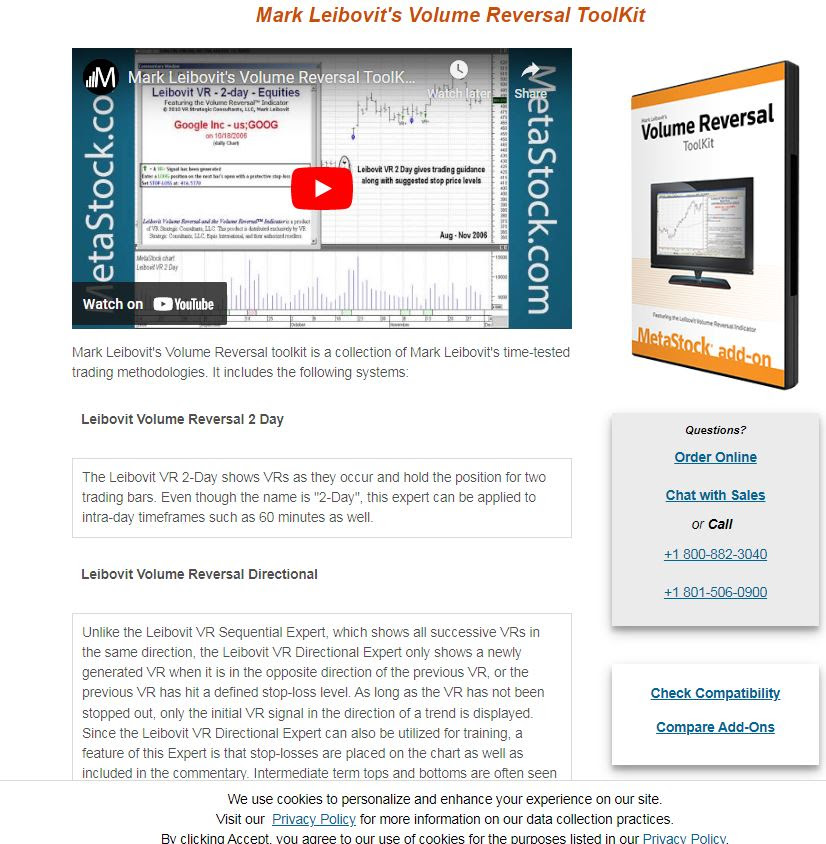

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada

Dow Closes Higher For Eighth Consecutive Session

Stocks moved to the upside early in the session on Friday but showed a lack of direction over the remainder of the trading day. The major averages eventually ended the day mixed, although the Dow closed higher for the eighth consecutive session.

While the tech-heavy Nasdaq edged down 5.40 points or less than a tenth of a percent to 16,340.87, the S&P 500 crept up 8.60 points or 0.2 percent to 5,222.68 and the Dow rose 125.08 points or 0.3 percent to a new one-month closing high of 39,512.84.

For the week, the Nasdaq jumped by 1.1 percent, while the S&P 500 and the Dow surged by 1.9 percent and 2.2 percent, respectively.

The early strength on Wall Street partly reflected recently renewed optimism about the outlook for interest rates. Recent data has pointed to some softness in the U.S. labor market, increasing investor confidence the Federal Reserve will lower interest rates in the coming months.

While the Fed is still widely expected to leave interest rates unchanged in June, there is a 74.2 percent chance rates will be lower by September, according to CME Group's FedWatch Tool.

However, the early buying interest was partly offset by the release of a report from the University of Michigan showing a substantial deterioration in U.S. consumer sentiment in the month of May.

The University of Michigan said its consumer sentiment index plunged to 67.4 in May from 77.2 in April. Economists had expected the index to edge down to 76.0.

With the much steeper than expected drop, the consumer sentiment index tumbled to its lowest level since hitting 61.3 last November.

The report also showed a notable increase in year-ahead inflation expectations, which jumped to 3.5 percent in May from 3.2 percent in April, reaching the highest level since hitting 4.5 percent last November.

Long-run inflation expectations also inched up to 3.1 percent in May from 3.0 percent in April, remaining elevated relative to the 2.2-2.6 percent range seen in the two years pre-pandemic.

"Today's lower-than-expected consumer sentiment numbers are a warning sign that the consumer shouldn't be taken for granted," said Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance. "In addition, inflation expectations have been rising as well, which is a double whammy for the Fed.

He added, "If spending slows down and inflation increases, we'll get the opposite of the Goldilocks scenario that many were hoping for, and the Fed will be in an especially difficult position of choosing between accommodating a slowing economy and fighting increasing inflation expectations."

Sector News

Most of the major sectors showed only modest moves on the day, contributing to the lackluster performance by the broader markets.

Semiconductor stocks showed a strong move to the upside, however, with the Philadelphia Semiconductor Index climbing by 1.0 percent.

Networking stocks also saw notable strength on the day, while energy stocks came under pressure amid a decrease by the price of crude oil.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher during trading on Friday. Japan's Nikkei 225 Index rose by 0.4 percent, while Hong Kong's Hang Seng Index surged by 2.3 percent.

The major European markets also moved to the upside on the day. While the U.K.'s FTSE 100 Index advanced by 0.6 percent, the German DAX Index and the French CAC 40 Index climbed by 0.5 percent and 0.4 percent, respectively.

In the bond market, treasuries came under pressure over the course of the session. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, climbed 5.5 basis points to 4.504 percent.

Looking Ahead

Inflation data is likely to be in the spotlight next week, with the Labor Department due to release its closely watched reports on consumer and producer prices in the month of April.

U.S. Stocks Move Mostly Higher, Dow Extends Winning Streak To Seven Days

‘Phantom debt’ from ‘buy now, pay later’ schemes is a $700 billion black hole that economists aren’t accounting for -Fortune

by Eleanor Pringle

Wall Street is generally convinced the economic health of the U.S. consumer is remarkably better than expected after COVID, but one analyst has pointed out there's a gaping hole in the picture.

He calls it "phantom debt"—spending on "buy now, pay later" (BNPL) platforms, which often goes unrecorded by credit agencies.

Big bank CEOs have continually expressed their shock and delight at how well consumers are apparently faring.

JP Morgan Chase CEO Jamie Dimon recently said the consumer is in "pretty good shape" while the economy is "booming."

Meanwhile, Bank of America CEO Brian Moynihan has encouraged Jerome Powell to be "mindful" of relying too heavily on consumers to prop up the economy, as they will eventually reach their breaking point.

While Citi CEO Jane Fraser has pointed out the "cracks" beginning to appear at the bottom end of the income ladder, a Wells Fargo analyst has also flagged a personal finance feature that is largely overlooked by the sector: people purchasing products—contributing to stronger sales for brands—but without paying the full balance at the time of sale.

Instead, payment for these products is taken in installments over a longer period of time—some of which come with service fees or with fluctuating repayment options depending on an individual's perceived credit reliability.

The problem with this, for economists at least, is that the larger BNPL platforms often decline to share their customers' purchasing patterns with some or all credit bureaus, concerned that their customers' activity may ultimately bring down their credit score. Afterpay, for example, shares none of its data with credit agencies, while Klarna shares its data with U.K. credit bodies.

BNPL lenders may also report some but not all of their data. For example, in the U.K., BNPL providers are required to share a customer's credit and repayment history for products with a short repayment window or multiple smaller payments across various accounts.

This black hole of information between BNPL lenders and credit agencies across the world is why Wells Fargo senior economist Tim Quinlan has coined the term "phantom debt," per Bloomberg, saying experts have been “lulled into complacency about where consumers are" as a result.

“People need to be more awake to the risk of BNPL,” Quinlan added.

Billionaire Barry Sternlicht predicts weekly bank closures as the real estate sector battles high interest rates and inflation - Business Insider

by Erin Snodgrass

Billionaire Barry Sternlicht offered an ominous prediction about America's regional banks amid a coming commercial real estate reckoning.

The Starwood Capital Group CEO told CNBC on Tuesday that he thinks real estate's primary lenders — regional and community banks — could soon be bearing the brunt of high interest rates and inflation.

"You're going to see a regional bank fail every day, or not — every week, maybe two a week," Sternlicht said.

There are more than 4,000 regional and community banks throughout the US, many of which may not have the cash flow to handle major loan losses on real estate debt.

Problems have been pummeling the entirety of the real estate sector, but commercial real estate, in particular, has been struggling due to the rise of remote and hybrid work, leading to more and more vacancies.

Sternlicht has been ringing the warning bells for more than two years, calling the situation an "existential crisis" in a January Bloomberg interview. Earlier this year, he predicted $1 trillion of losses on office properties alone. In the Tuesday interview, Sternlicht said Fed Chair Jerome Powell's ongoing rate hikes will continue to have consequences in the real estate sector for the foreseeable future.

"He's got a hard task with a blunt tool, and the consequence is the real estate markets are taking it on the chin because rates rose so fast. We could have handled this, but we couldn't handle it this fast," Sternlicht said. "The 1.9 trillion of real estate loans, that's a fragile animal right now."

BRICS: Economist Predicts One Final Rally Before the Markets Crash 50% -watcher.guru

by Vinod Dsouza

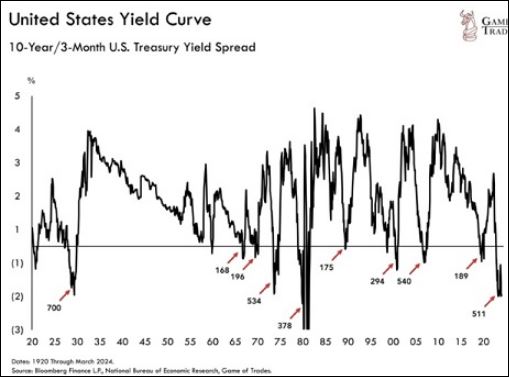

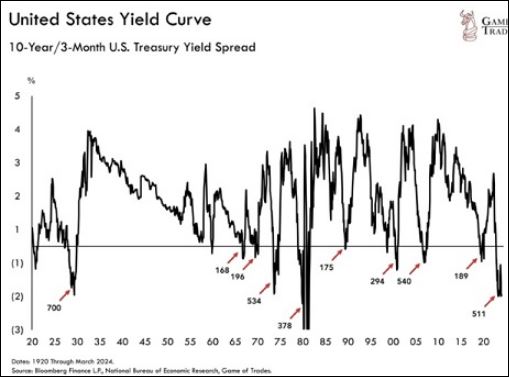

yield curveSpeculations of a recession have been looming large since 2022 as economists have been repeatedly warning about an upcoming market crash. According to economists, the crash could be more severe than the 2008 economic crisis and replicate the worst recession since 1929. If the market crashes, BRICS will benefit as the US economy will suffer the consequences of their own making. The uncontrolled debt of $34.4 trillion is spiraling leading to other developing countries ditching the US dollar for global trade.

On the heels of the BRICS alliance looking to dominate the world’s financial sector, a macro economist shared his views that the US markets could rally one last time before tanking 50% or more. This time around, not all countries will be affected if the US economy crashes as developing countries are increasingly accumulating gold in their reserves. BRICS countries have been the largest buyers of gold since 2022 and are safeguarding their economies from a potential US market crash.

US macroeconomist Henrik Zeberg warned that the American markets could replicate the Great Depression of 1929 in 2024. He listed the observations pointed out by the Game of Trades, which shows similar chart patterns that led to previous market crashes. The BRICS alliance is hoping for the US market to crash to further strengthen its de-dollarization agenda

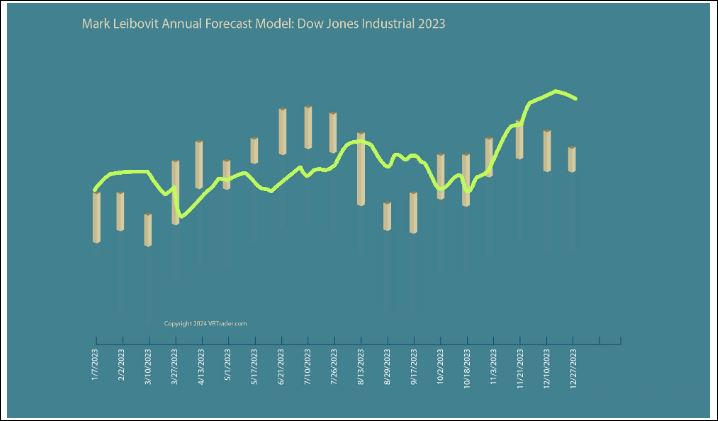

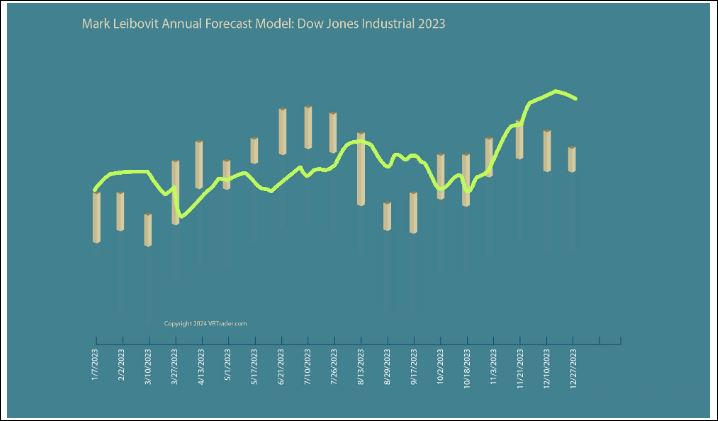

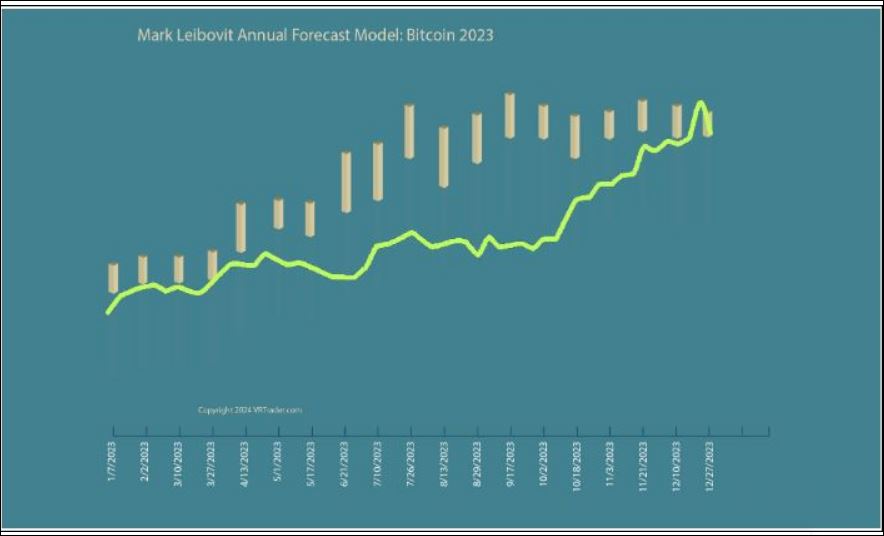

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

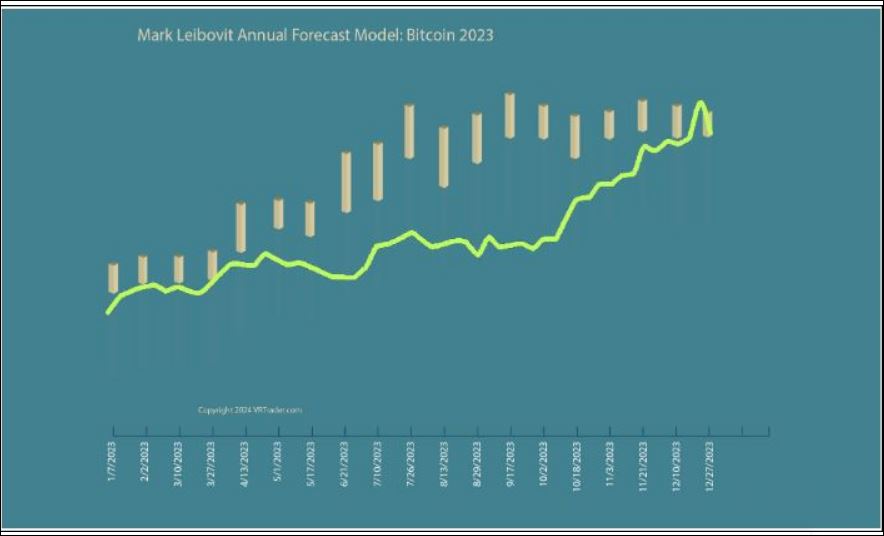

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://tinyurl.com/2rd9wv52

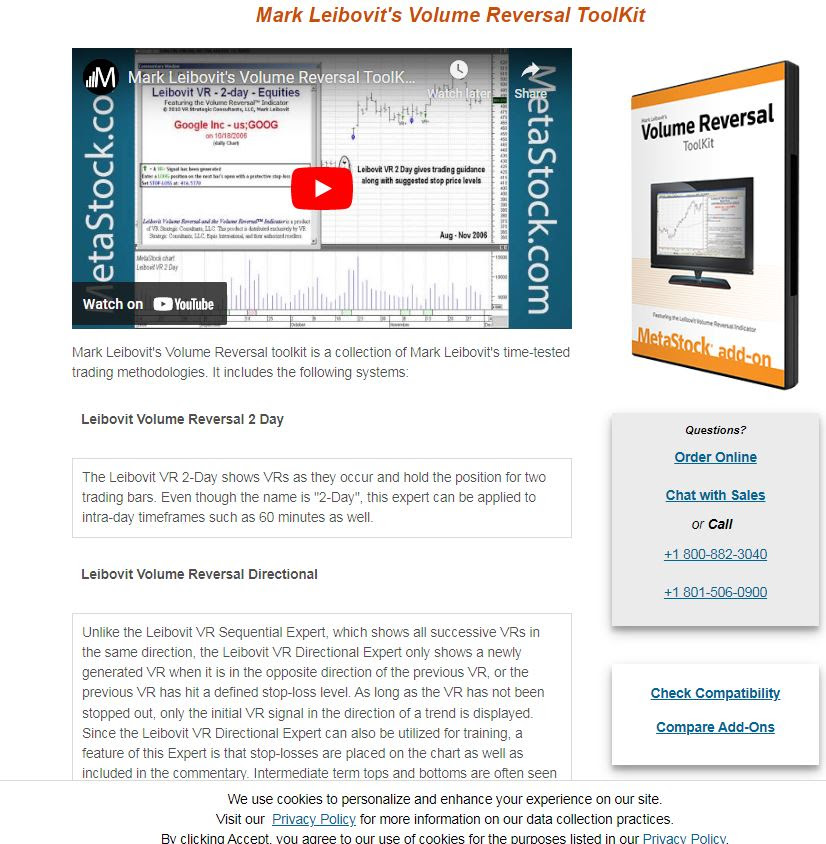

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

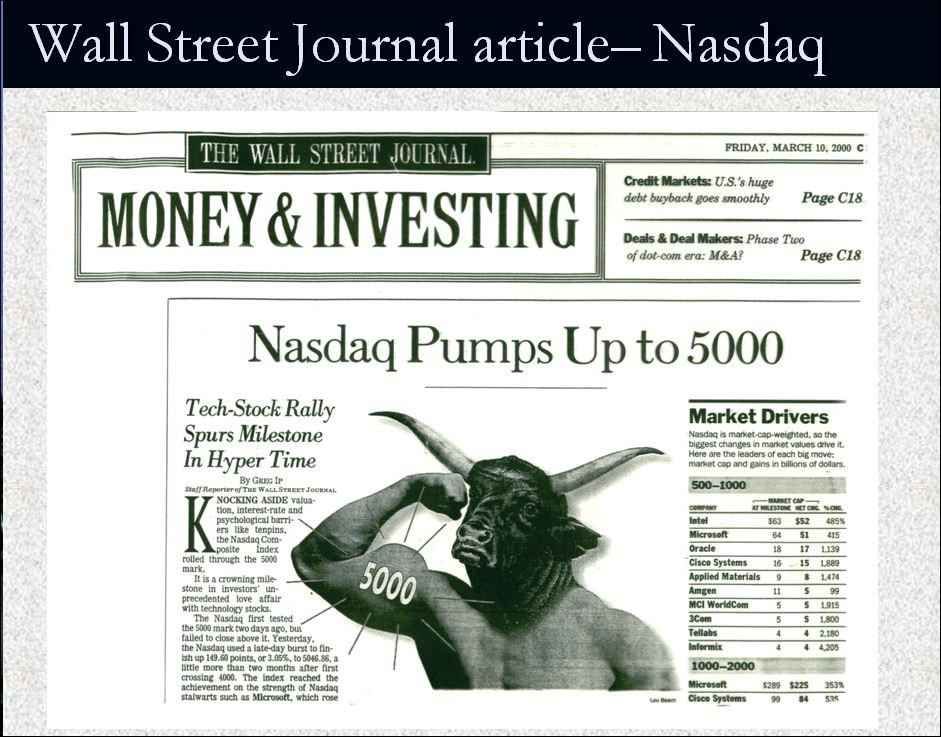

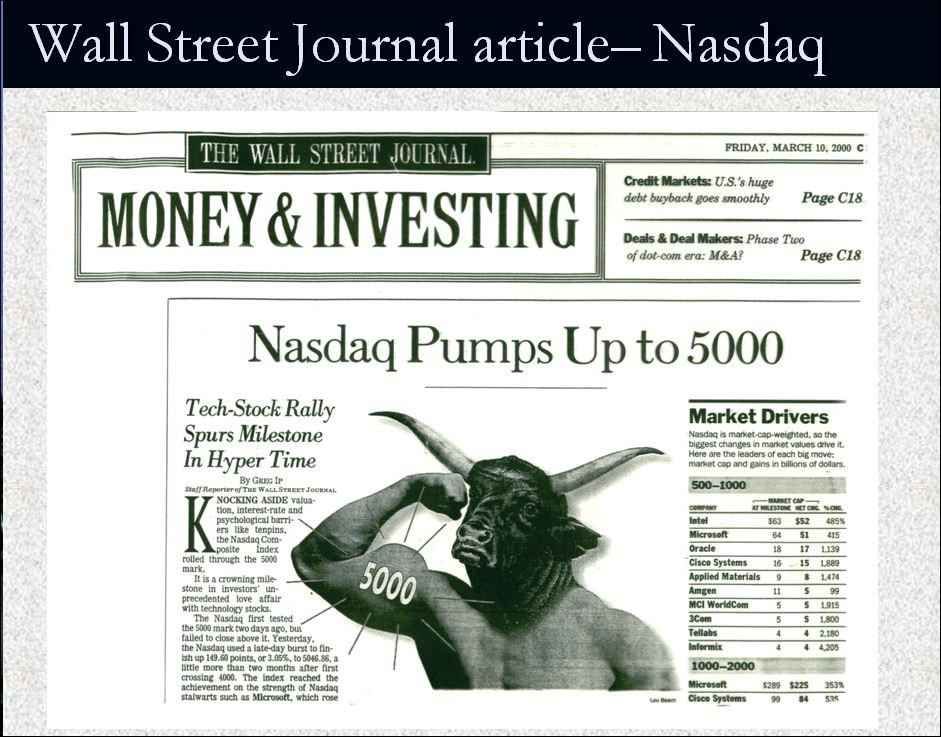

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

LEIBOVIT VR NEWSLETTERS - FRIDAY - MAY 10, 2024

https://www.howestreet.com/2024/05/us-marijuana-stocks-going-sky-high-mark-leibovit/

NEXT UPDATE POSTED THIS WEEKEND

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada

U.S. Stocks Move Mostly Higher, Dow Extends Winning Streak To Seven Days

Following the lackluster performance seen over the two previous sessions, stocks moved mostly higher during trading on Thursday. The Dow extended its winning streak to seven sessions, once again reaching its best closing level in over a month.

The major averages ended the day just off their highs of the session. The Dow jumped 331.37 points or 0.9 percent to 39,387.76, the S&P 500 climbed 26.41 points or 0.5 percent to 5,214.08 and the Nasdaq rose 43.51 points or 0.3 percent to 16,346.26.

The strength on Wall Street came following the release of a Labor Department report showing a much bigger than expected increase by first-time claims for U.S. unemployment benefits in the week ended May 4th.

The report said initial jobless claims climbed to 231,000, an increase of 22,000 from the previous week's revised level of 209,000.

Economists had expected jobless claims to inch up to 210,000 from the 208,000 originally reported for the previous week.

With the much bigger than expected increase, jobless claims reached their highest level since hitting 234,000 in week ended August 26th.

The data may added to recently renewed optimism that the Federal Reserve will lower interest rates in the coming months.

While the Fed is still widely expected to leave interest rates unchanged in June, the chances rates will be lower by September have reached 89.3 percent, according to CME Group's FedWatch Tool.

Among individual stocks, shares of AppLovin (APP) skyrocketed after the mobile technology company reported first quarter results that beat expectations on both the top and bottom lines.

Glasses retailer Warby Parker (WRBY) also showed a substantial move to the upside after reporting a narrower than expected first quarter loss on revenues that exceeded estimates.

On the other hand, shares of Airbnb (ABNB) moved sharply lower after the vacation rental company reported better than expected first quarter results but provided disappointing guidance.

Sector News

Telecom stocks moved sharply higher over the course of the trading session, resulting in a 4.2 percent spike by the NYSE Arca North American Telecom Index.

Significant strength was also visible among gold stocks, as reflected by the 2.5 percent jump by the NYSE Arca Gold Bugs Index. The strength in the sector came amid an increase by the price of gold.

Commercial real estate stocks also showed a strong move to the upside on the day, driving the Dow Jones U.S. Real Estate Index up by 2.1 percent.

Oil service, housing and steel stocks also saw considerable strength, moving higher along with most of the other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in another mixed performance during trading on Thursday. Japan's Nikkei 225 Index fell by 0.3 percent, while Hong Kong's Hang Seng Index surged by 1.2 percent.

Meanwhile, the major European markets all moved to the upside on the day. While the German DAX Index jumped by 1.0 percent, the French CAC 40 Index climbed by 0.7 percent and the U.K.'s FTSE 100 Index rose by 0.3 percent.

In the bond market, treasuries rebounded following the modest pullback seen on Wednesday. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, slid 4.3 basis points to a one-month closing low of 4.449 percent.

Looking Ahead

Trading on Friday may be impacted by reaction to a report on consumer sentiment in the month of May, which includes readings on inflation expectations. Remarks by several Fed officials may also attract attention along with the latest earnings news.

BRICS: Economist Predicts One Final Rally Before the Markets Crash 50% -watcher.guru

by Vinod Dsouza

yield curveSpeculations of a recession have been looming large since 2022 as economists have been repeatedly warning about an upcoming market crash. According to economists, the crash could be more severe than the 2008 economic crisis and replicate the worst recession since 1929. If the market crashes, BRICS will benefit as the US economy will suffer the consequences of their own making. The uncontrolled debt of $34.4 trillion is spiraling leading to other developing countries ditching the US dollar for global trade.

On the heels of the BRICS alliance looking to dominate the world’s financial sector, a macro economist shared his views that the US markets could rally one last time before tanking 50% or more. This time around, not all countries will be affected if the US economy crashes as developing countries are increasingly accumulating gold in their reserves. BRICS countries have been the largest buyers of gold since 2022 and are safeguarding their economies from a potential US market crash.

US macroeconomist Henrik Zeberg warned that the American markets could replicate the Great Depression of 1929 in 2024. He listed the observations pointed out by the Game of Trades, which shows similar chart patterns that led to previous market crashes. The BRICS alliance is hoping for the US market to crash to further strengthen its de-dollarization agenda

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]