News & Updates

LEIBOVIT VR NEWSLETTERS - WEIRD WOLLIE WEDNESDAY FOLLOWING 'TURNAROUND TUESDAY' - NOTE THE ATLANTA FED CHIEF FEEDS THE MARKET BULLISH COMMENTARY - APRIL 10, 2024

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

MORE BLACK SWANS ARE UNDERWAY

THE DECEMBER 21-22 WINTER SOLSTICE DEFINED A MARKET TOPPING PROCESS AND NOW WE'RE FOCUSING IN ON THE VERNAL EQUINOX WHICH IN HINDSGHT WAS COINCIDENT WITH ANOTHER MARKET PEAK.

FOMC MEETINGS 2024

MAY 1

JUNE 12

JULY 31

SEPT 18

NOV 7

DEC 18

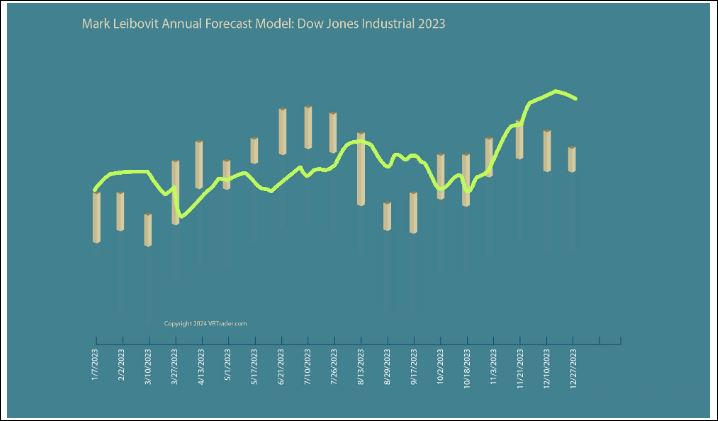

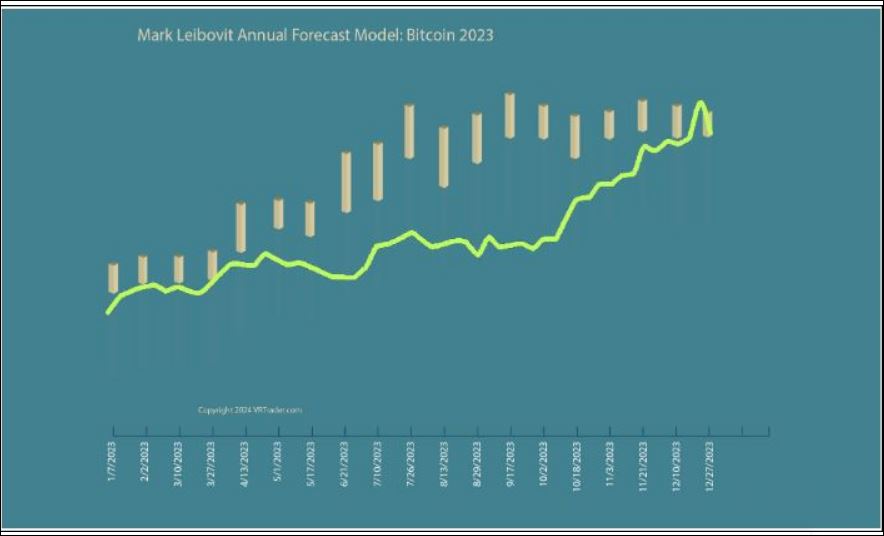

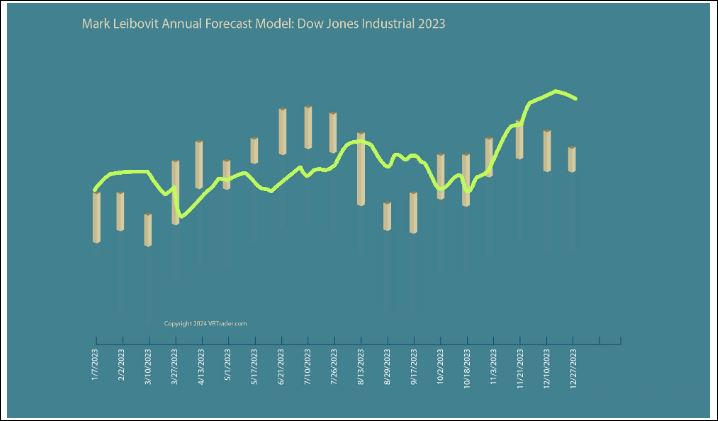

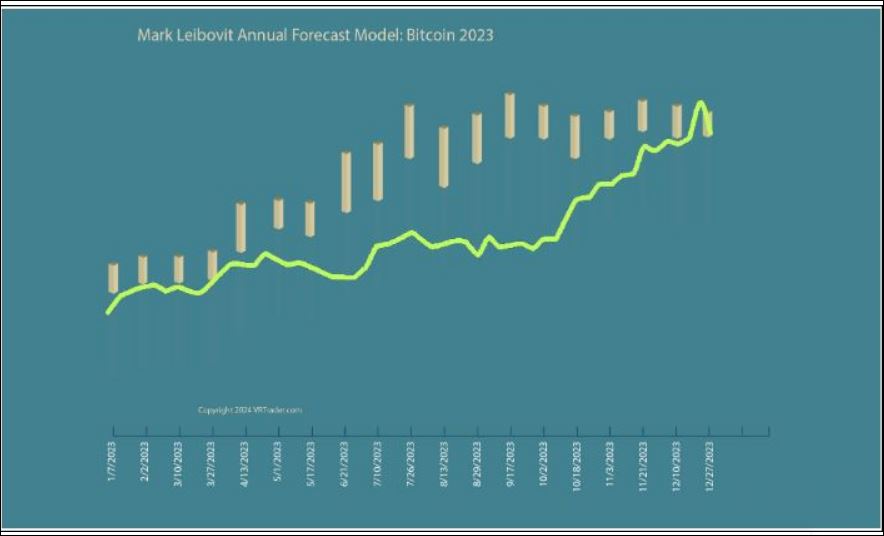

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

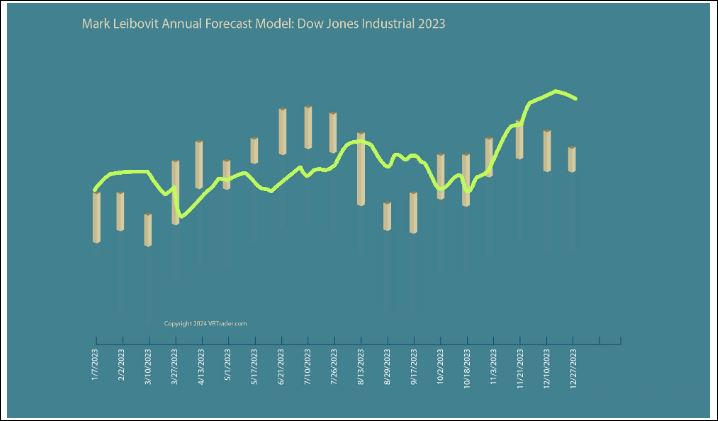

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

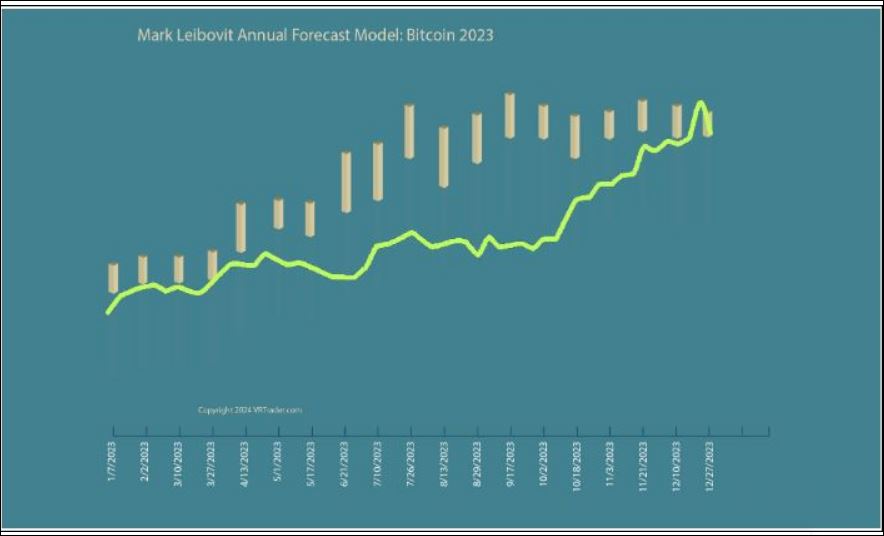

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

NEXT PODCAST - THURSDAY EVENING

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

Following the lackluster performance seen on Monday, stocks saw considerable volatility over the course of the trading session on Tuesday. The major averages fluctuated as the day progressed, with the Nasdaq and the S&P 500 eventually closing in positive territory.

THE PRESS IS NOT REPORTING THAT RAPHAEL BOSTIC, THE HEAD OF THE FEDERAL RESERVE OF ATLANTA LEAKED A STORY THAT RATE CUTS COULD BE MOVED UP IF THE PACE OF DISINFLATION CONTINUES. THIS THE PLUNGE PROTECTION AT WORK, FOLKS!

While the Nasdaq rose 52.68 points or 0.3 percent to 16,306.64 and the S&P 500 inched up 7.52 points or 0.1 percent to 5,209.91, the narrower Dow ended the day slightly lower, edging down 9.13 points or less than a tenth of a percent to 38,883.67.

The volatility on Wall Street came as traders continued to look ahead to the release of the Labor Department's report on consumer price inflation on Wednesday.

Economists currently expect consumer prices to rise by 0.3 percent in March following a 0.4 percent increase in February.

Core consumer prices, which exclude food and energy prices, are also expected to climb by 0.3 percent in March after rising by 0.4 percent in February.

The annual rate of consumer price growth is expected to accelerate to 3.4 percent in March from 3.2 percent in February, while the annual rate of core consumer price growth is expected to slow to 3.7 percent for 3.8 percent.

The inflation data could have a significant impact on the outlook for interest rates, as Federal Reserve officials have repeatedly said they need greater confidence inflation is slowing before cutting rates.

Wednesday will also see the release of the minutes of the Fed's latest monetary policy meeting, which could also shed additional light on officials' thinking on rates.

"The central bank wants to see sustained evidence of inflation coming down and that doesn't appear to be on the menu," said Dan Coatsworth, investment analyst at AJ Bell.

"The signs are clear for investors to see, but many have been choosing to ignore them," he added. "The Fed putting it into black and white could be a difficult pill for investors to swallow, so brace yourself for turbulence on the market this week."

Sector News

Gold stocks showed a significant rebound following the pullback seen on Monday, driving the NYSE Arca Gold Bugs Index up by 1.9 percent to a nearly eleven-month closing high.

The strength among gold stocks came amid an increase by the price of the precious metal, which climbed to a new record high.

Considerable strength also emerged among biotechnology stocks, as reflected by the 1.6 percent gain posted by the NYSE Arca Biotechnology Index.

Networking, commercial real estate and telecom stocks also showed notable moves to the upside, while energy stocks saw some weakness amid a steep drop by the price of crude oil.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Tuesday. Japan's Nikkei 225 Index jumped by 1.1 percent, while South Korea's Kospi fell by 0.5 percent.

Meanwhile, the major European markets all moved to the downside on the day. While the German DAX Index tumbled by 1.3 percent, the French CAC 40 Index slumped by 0.9 percent and the U.K.'s FTSE 100 Index edged down by 0.1 percent.

In the bond market, treasuries regained ground after moving notably lower over the two previous sessions. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, is down by 5.6 basis points at 4.368 percent.

Looking Ahead

Early trading on Wednesday is likely to be driven by reaction to the consumer price inflation data, while the Fed minutes may attract attention later in the day.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

https://www.spaceweather.com/

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - 'TURNAROUND TUESDAY' - APRIL 9, 2024

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

BLACK SWANS ARE UNDERWAY

Just as the solar eclipse arrives, scientists are now admitting they recently (and covertly) launched a geoengineering experiment in San Francisco that aims to darken the skies by launching salt pollutants into the atmosphere. While the corporate media mocks Tennessee for passing anti-chemtrails legislation by claiming geoengineering is a "conspiracy theory," scientists in San Francisco are actively pursuing geoengineering experiments that would, if scaled up, absolutely devastate plants and crops across the planet.

THE DECEMBER 21-22 WINTER SOLSTICE DEFINED A MARKET TOPPING PROCESS AND NOW WE'RE FOCUSING IN ON THE VERNAL EQUINOX WHICH IN HINDSGHT WAS COINCIDENT WITH ANOTHER MARKET PEAK.

FOMC MEETINGS 2024

MAY 1

JUNE 12

JULY 31

SEPT 18

NOV 7

DEC 18

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

Following the substantial volatility seen over the final two sessions of the previous week, stocks turned in a relatively lackluster performance during trading on Monday. The major averages spent the day bouncing back and forth across the unchanged line before eventually closing narrowly mixed.

While the Nasdaq crept up 5.44 points or less than a tenth of a percent to 16,253.96, the Dow edged down 11.24 points or less than a tenth of a percent to 38,892.80 and the S&P 500 slipped 1.95 points or less than a tenth of a percent to 5,202.39.

The choppy trading on the day came as traders seemed reluctant to make significant moves ahead of the release of closely watched inflation data later in the week.

Some investors may also have been away from their desks as they traveled to other parts of the country to get a better view of today's total solar eclipse.

The Labor Department is scheduled to release its reports on consumer and producer inflation in the month of March on Wednesday and Thursday, respectively.

Economists currently expect consumer prices to rise by 0.3 percent in March following a 0.4 percent increase in February.

Core consumer prices, which exclude food and energy prices, are also expected to climb by 0.3 percent in March after rising by 0.4 percent in February.

The annual rate of consumer price growth is expected to accelerate to 3.4 percent in March from 3.2 percent in February, while the annual rate of core consumer price growth is expected to slow to 3.7 percent for 3.8 percent.

Producer prices are expected to rise by 0.3 percent in March after climbing by 0.6 percent in February, while the annual rate of producer growth is expected to jump to 2.3 percent from 1.6 percent.

The inflation data could have a significant impact on the outlook for interest rates, as Federal Reserve officials have repeatedly said they need greater confidence inflation is slowing before cutting rates.

Wednesday will also see the release of the minutes of the Fed's latest monetary policy meeting, which could also shed additional light on officials' thinking on rates.

Sector News

Most of the major sectors ended the day showing only modest moves, contributing to the lackluster close by the broader markets.

Airline stocks showed a strong move to the upside, however, with the NYSE Arca Airline Index jumping by 1.8 percent.

Significant strength was also visible among steel stocks, as reflected by the 1.8 percent gain posted y the NYSE Arca Steel Index.

Banking stocks also turned in a strong performance on the day, while gold stocks gave back ground following recent strength.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher on Monday. Japan's Nikkei 225 Index jumped by 0.9 percent and Hong Kong's Hang Seng Index inched up by 0.1 percent, although China's Shanghai Composite

Index bucked the uptrend and slid by 0.7 percent.

The major European markets also moved to the upside on the day. While German DAX Index advanced by 0.8 percent, the French CAC 40 Index climbed by 0.7 percent and the U.K.'s FTSE 100 Index rose by 0.4 percent.

In the bond market, treasuries extended the notable downward move seen last Friday. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, climbed 4.6 basis points to 4.424 percent.

Looking Ahead

A lack of major U.S. economic data may lead to another choppy trading session on Tuesday ahead of the inflation data due later this week.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

LEIBOVIT VR NEWSLETTERS - MONDAY - APRIL 8, 2024 - THE DAY AMERICA LOOKED TO THE SKIES AND HOPES THE GROUND UNDER THEM DOES NOT TREMBLE

Courtesy Ray Merriman:

The path of eclipse totality will go right over Niagara Falls at 3:15 PM on Monday. Niagara Falls generates an enormous amount of hydropower and was once a Category 5 earthquake fault line. Additionally, the path of totality will crisscross a previous eclipse that happened in the U.S. in 2017 over southwest Missouri. The New Madrid fault line runs through that area. What does this mean? Well, first of all, understand that earthquakes do not always happen exactly on the day of the eclipse. They can be a few months off. However, in several cases, they occurred on the line of the eclipse path a few months later. Second, understand that there really isn’t too much you can do, for earthquakes are outside of one’s ability to control. You can have a plan to seek safety if one occurs. But you cannot pinpoint the exact time AND location when one will occur (although I am certain that if one does occur, someone will claim to have predicted it). It does very little good to fret over something you cannot control. Just be alert and have a plan if you are in a region (the eclipse path) that is vulnerable to any kind of natural calamity. But also know that if a calamity were to occur on the eclipse path, it could be several months after the moment of the eclipse.

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

THE BALTIMORE BRIDGE COLLAPSE MAY HAVE BEEN THE BEGINING. THE EFFECTS OF THE APRIL SOLAR ECLIPSE! SEISMIC RUMBLINGS 150 OFF THE COAST OF VANCOUVER ISLAND, THE TAIWAN EARTHQUAKE, EARTHQUAKE IN NEW YORK. AND, NOW AN POTENTIALLY EXPLOSIE IRAN/ISRAEL CONFRONTATION NOW UNDERWAY. MERCURY RETROGRADE BEGUN APRIL 1. NEW MOON AND THE SOLAR ECLIPSE ON APRIL 8.

THE DECEMBER 21-22 WINTER SOLSTICE DEFINED A MARKET TOPPING PROCESS AND NOW WE'RE FOCUSING IN ON THE VERNAL EQUINOX TO LIKELY PERFORM THE OPPOSITE - A LOW POINT IN THE MARKET

FOMC MEETINGS 2024

MAY 1

JUNE 12

JULY 31

SEPT 18

NOV 7

DEC 18

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

U.S. Stocks Show Significant Rebound Following Strong Jobs Data

Following the sell-off seen late in the previous session, stocks showed a significant move back to the upside during trading on Friday. The major averages all moved notably higher, largely offsetting Thursday's steep losses.

The major averages finished the day off their highs of the session but still firmly in positive territory. The Nasdaq surged 199.44 points or 1.2 percent to 16,248.52, the S&P 500 jumped 57.13 points or 1.1 percent to 5,204.34 and the Dow advanced 307.06 points or 0.8 percent to 38,904.04.

Despite the rebound on the day, the major averages all moved lower for the week. The Dow plunged by 2.3 percent, while the S&P 500 slumped by 1.0 percent and the Nasdaq slid by 0.8 percent.

The rebound on the day came as traders looked to pick up stocks at relatively reduced levels following the steep drop seen during Thursday's session, which dragged the Dow down to its lowest closing level in a month.

Traders also reacted positively to a closely watched Labor Department report showing much stronger than expected job growth in the month of March.

The Labor Department said non-farm payroll employment spiked by 303,000 jobs in March after surging by a downwardly revised 270,000 jobs in February.

Economists had expected employment to jump by 200,000 jobs compared to the addition of 275,000 jobs originally reported for the previous month.

The report also said the unemployment rate edged down to 3.8 percent in March from 3.9 percent in February, while economists had expected the unemployment rate to come in unchanged.

While the stronger than expected job growth may have added to recent concerns about the outlook for interest rates, the report also showed a continued slowdown in the annual rate of wage growth.

The Labor Department said the annual rate of wage growth slowed to 4.1 percent in March from 4.3 percent in February, in line with estimates.

"While wages are growing solidly, their growth rate has moderated to the least since mid-2021," said Bill Adams, Chief Economist for Comerica Bank. "The economy-wide slowdown in inflationary pressures is extending to labor costs."

"The Fed will be glad to see wage growth normalizing," he added. "This jobs report will make the Fed more confident that inflation is moderating; they say more confidence on this point is a precondition for making rate cuts this year."

Gold stocks moved sharply higher following the pullback seen on Thursday, driving the NYSE Arca Gold Bugs Index up by 3.3 percent to its best closing level in well over ten months.

The rebound by gold stocks came amid a substantial increase by the price of the precious metal, with gold for June delivery surging $36.90 to $2,345.40 an ounce.

Significant strength was also visible among retail stocks, as reflected by the 1.7 percent gain being posted by the Dow Jones U.S. Retail Index.

Software, semiconductor and housing stocks also saw considerable strength on the day, moving higher along with most of the other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly lower during trading on Friday. Japan's Nikkei 225 Index plunged by 2.0 percent, while South Korea's Kospi slumped by 1.0 percent.

The major European markets also moved to the downside on the day. While the U.K.'s FTSE 100 Index slid by 0.8 percent, the French CAC 40 Index and the German DAX Index tumbled by 1.1 percent and 1.2 percent, respectively.

In the bond market, treasuries regained some ground after an early sell-off but remained firmly negative. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, climbed 6.9 basis points to 4.378 percent.

Looking Ahead

Inflation data will move back into the spotlight next week, with the Labor Department due to release its reports on consumer and producer price inflation in the month of March.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]