News & Updates

LEIBOVIT VR NEWSLETTERS - WEDNESDAY - MAY 15, 2024

The United States is not yet the closest it has ever been to default, but that may soon change. The secretary of the Treasury has indicated that it is unlikely the federal government will have sufficient cash or borrowing authority to pay all anticipated obligations due on June 1. According to a report from late 2023, the National Bureau of Economic Research (NBER) believes that 385 American banks could fail because of commercial real estate loans. That is the big danger we see, bigger than the building owners failing. In fact, one regional bank, Philadelphia’s Republic First Bancorp, failed last Friday.

Not new, but got to watch this clip regarding the FED and printing money

https://tinyurl.com/46nj8bsj

https://www.howestreet.com/2024/05/gold-oil-dow-real-estate-mortgage-rates-evs-mark-leibovit-hilliard-macbeth-ross-clark-this-week-in-money/

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

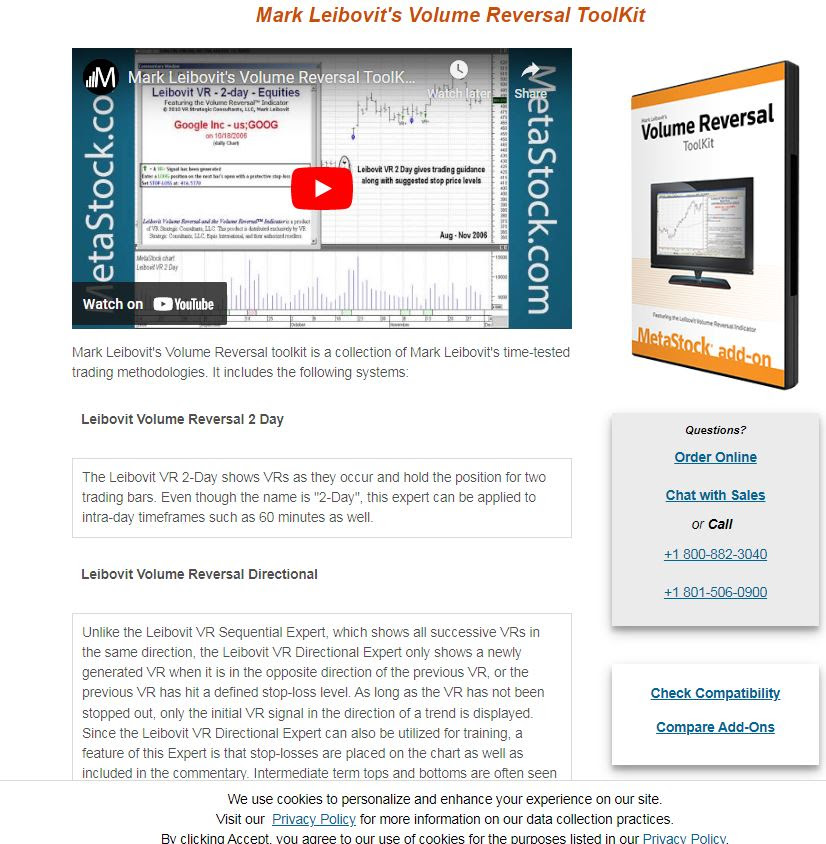

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada

U.S. Stocks Close Mostly Higher After Choppy Trading Session

Stocks fluctuated over the course of the trading session on Tuesday before eventually ending the day mostly higher. The major averages all moved to the upside, with the Dow bouncing back after snapping an eight-day winning streak on Monday.

The tech-heavy Nasdaq led the way higher, advancing 122.94 points or 0.8 percent to a new record closing high of 16,511.18. The S&P 500 climbed 25.26 points or 0.5 percent to 5,246.68 and the Dow rose 126.60 points or 0.3 percent to 39,558.11.

The higher close on Wall Street came as treasury yields moved to the downside after an early advance, with the yield on the benchmark ten-year note falling to its lowest closing level in over a month.

Treasury yields initially moved higher following the release of a Labor Department report showing producer prices in the U.S. increased by more than expected in the month of April.

The Labor Department said its producer price index for final demand climbed by 0.5 percent in April after a revised 0.1 percent dip in March.

Economists had expected producer prices to rise by 0.3 percent compared to the 0.2 percent uptick originally reported for the previous month.

The report also said the annual rate of producer price growth accelerated to 2.2 percent in April from a downwardly revised 1.8 percent in March.

The year-over-year producer price growth was expected to inch up to 2.2 percent from the 2.1 percent originally reported for the previous month.

However, while the report initially generated renewed uncertainty about the outlook for interest rates, some economists pointed to the downward revisions to the March data as a positive sign.

"In effect, with the revision, the PPI rise was as expected. Proof of that was in the 2.2%, as-expected rise in the year-on-year PPI," said FHN Financial Chief Economist Chris Low. "Still, it is not all benign, as there is brewing pressure in the Core PPI."

Traders also kept an eye on remarks by Federal Reserve Chair Jerome Powell at the annual general meeting of the Foreign Bankers' Association.

Powell said the central bank needs to "be patient and let restrictive policy do its work," noting a lack of further progress on inflation during the first quarter.

The Fed chief also said his confidence inflation will slow towards the 2 percent target is "not as high as it was" but reiterated he does not expect the next move to be a rate hike.

With regard to the producer price inflation report, Powell said he'd call the data "mixed" rather than "hot" due the downward revisions to the March data.

Sector News

Networking stocks moved sharply higher over the course of the session, driving the NYSE Arca Airline Index up by 3.0 percent to its best closing level in over a month.

Computer hardware and semiconductor stocks also saw significant strength on the day, contributing to the advance by the tech-heavy Nasdaq.

Considerable strength was also visible among airline stocks, as reflected by the 1.2 percent gain posted by the NYSE Arca Airline Index.

Gold, brokerage and tobacco stocks also saw notable strength, moving higher along with most of the other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in another mixed performance during trading on Tuesday. Japan's Nikkei 225 Index climbed by 0.5 percent while Hong Kong's Hang Seng Index slipped by 0.2 percent.

The major European markets also ended the day narrowly mixed. While the German DAX Index edged down by 0.1 percent, the U.K.'s FTSE 100 Index and the French CAC 40 Index both crept up by 0.2 percent.

In the bond market, treasuries moved higher over the course of the session after seeing initial weakness. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, fell 3.6 basis points to a one-month closing low of 4.445 percent.

Looking Ahead

Consumer price inflation data is likely to be in focus on Wednesday, although reports on retail sales and homebuilder confidence may also attract some attention.

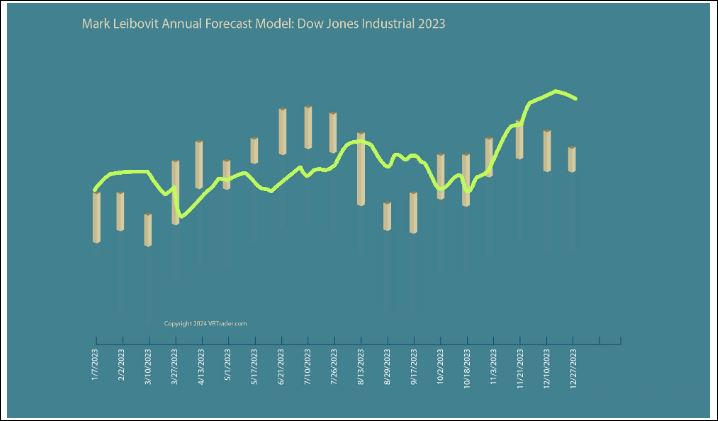

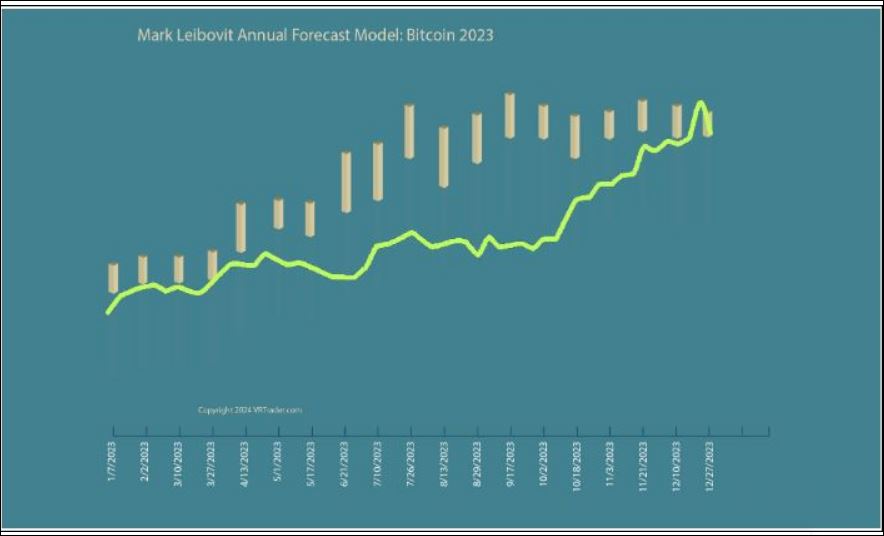

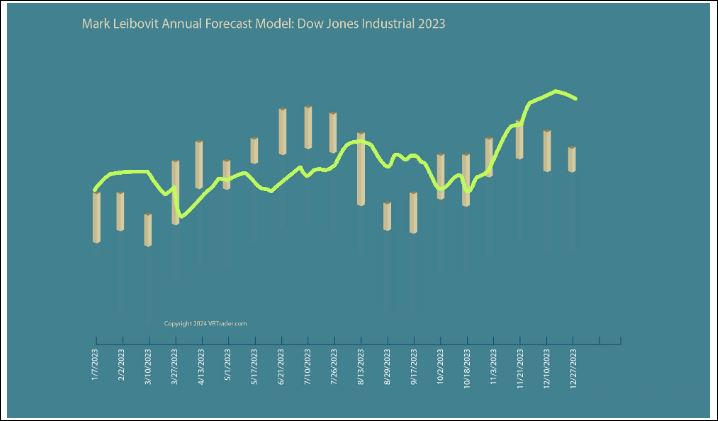

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

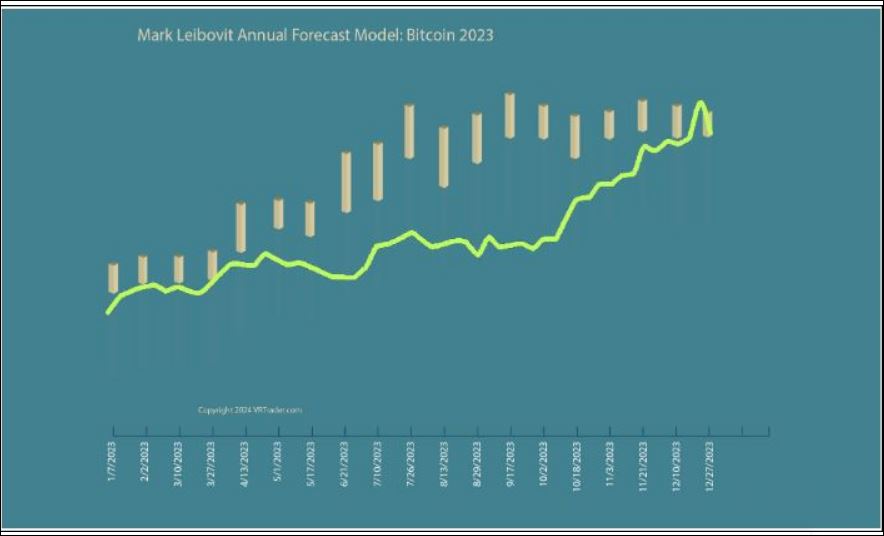

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

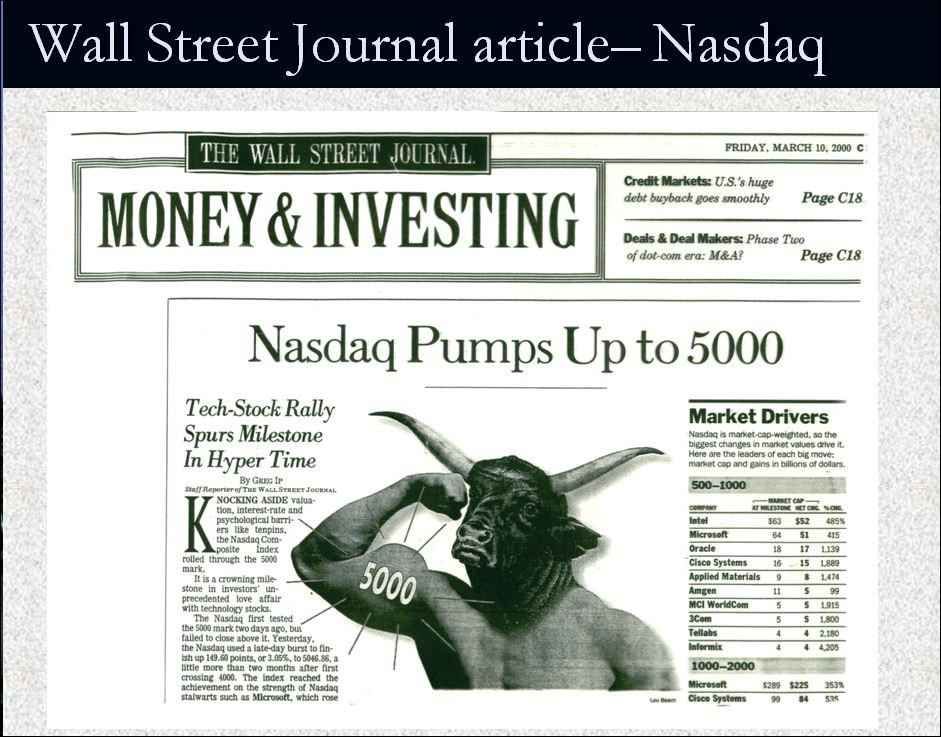

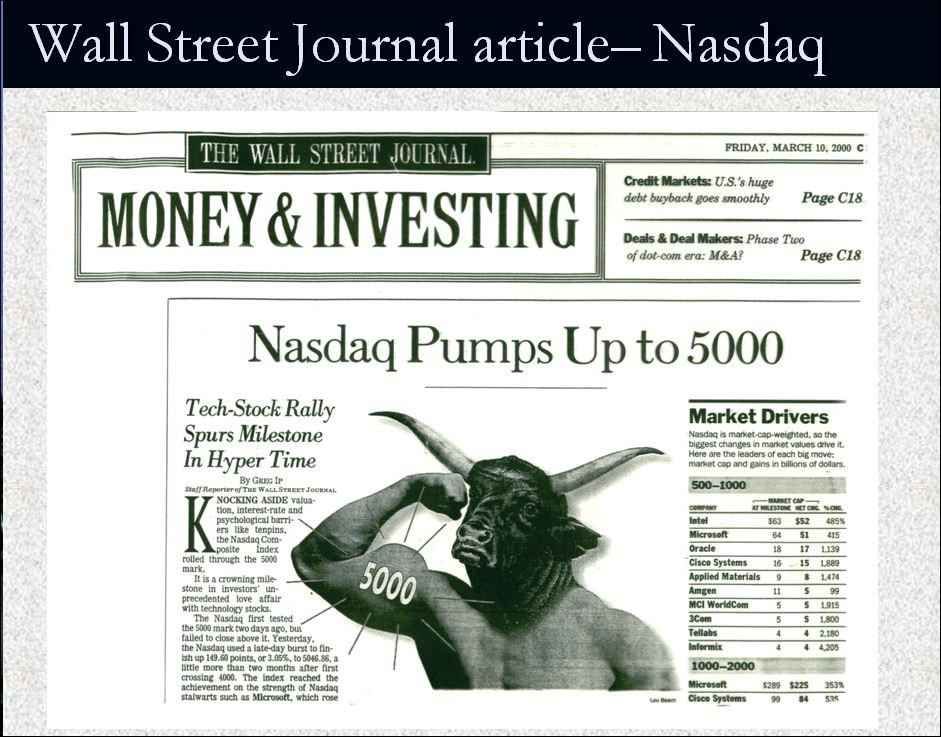

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - 'TURNAROUND TUESDAY' - MAY 14, 2024

The United States is not yet the closest it has ever been to default, but that may soon change. The secretary of the Treasury has indicated that it is unlikely the federal government will have sufficient cash or borrowing authority to pay all anticipated obligations due on June 1

Not new, but got to watch this clip regarding the FED and printing money

https://tinyurl.com/46nj8bsj

https://www.howestreet.com/2024/05/gold-oil-dow-real-estate-mortgage-rates-evs-mark-leibovit-hilliard-macbeth-ross-clark-this-week-in-money/

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada

Dow Snaps Eight-Day Winning Streak After Lackluster Session

Following the strong upward move seen last week, stocks turned in a relatively lackluster performance during trading on

Monday. The major averages moved to the upside early in the session but spent the day bouncing back and forth across the

unchanged line.

The major averages eventually ended the day narrowly mixed. While the Nasdaq rose 47.37 points or 0.3 percent to 16,388.24,

the S&P 500 edged down 1.26 points or less than a tenth of a percent to 5,221.42 and the Dow dipped 81.33 points or 0.2

percent to 39,431.51.

The early strength on Wall Street came as stocks continued to benefit from recent upward momentum, which led to an eight-

day winning streak for the Dow.

Renewed optimism about an interest rate cut by Federal Reserve in the coming months contributed to the recent strength.

Buying interest waned over the course of the session, however, as key inflation data due this week could have a significant

impact on the outlook for rates.

The Labor Department is scheduled to release its reports on producer and consumer price inflation on Tuesday and Wednesday,

respectively.

Economists expect producer prices to rise by 0.3 percent in April after edging up by 0.2 percent in March, while the annual

rate of growth is expected to tick up to 2.2 percent from 2.1 percent.

Consumer prices are expected to climb by 0.4 percent in April, matching the increase seen in March. Core consumer prices,

which exclude food and energy prices, are expected to rise by 0.3 percent in April after climbing by 0.4 percent in March.

The annual rate of consumer price growth is expected to dip to 3.4 percent in April from 3.4 percent in March, while the

annual rate of core consumer price growth is expected to slow to 3.6 percent from 3.8 percent.

Remarks by Fed Chair Jerome Powell may also attract attention this week along with reports on retail sales, industrial

production and housing starts.

Among individual stocks, shares of GameStop (GME) soared after social media persona "Roaring Kitty," whose posts helped

spark a frenzy of activity in the video game retailer's stock in 2021, posted on X for the first time in three years.

Website building and hosting company Squarespace (SQSP) also surged after entering into a definitive agreement to go

private in an all-cash transaction valued at approximately $6.9 billion.

Sector News

Most of the major sectors showed only modest moves on the day, contributing to the lackluster close by the broader markets.

Airline stocks showed a substantial move to the upside, however, with the NYSE Arca Airline Index surging by 2.5 percent.

American Airlines (AAL) and United Airlines (UAL) posted notable gains after HSBC initiated coverage of the stocks with Buy

ratings.

Considerable strength was also visible among biotechnology stocks, driving the NYSE Arca Biotechnology Index up by 1.1

percent to its best closing level in a month.

Shares of Incyte (INCY) spiked by 8.6 percent after the biotechnology company announced its Board of Directors approved a

share repurchase authorization of $2.0 billion.

Meanwhile, housing stocks came under pressure over the course of the session, dragging the Philadelphia Housing Sector

Index down by 1.0 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance on Monday. Japan's Nikkei

225 Index edged down by 0.1 percent and China's Shanghai Composite Index slipped by 0.2 percent, while Hong Kong's Hang

Seng Index advanced by 0.8 percent.

Meanwhile, the major European markets all moved modestly lower on the day. While the French CAC 40 Index slipped by 0.1

percent, the German DAX Index and the U.K.'s FTSE 100 Index both dipped by 0.2 percent.

In the bond market, treasuries saw a modest rebound following the pullback seen last Friday. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, dipped 2.3 basis points to 4.481 percent.

Looking Ahead

The Labor Department's report on producer price inflation is likely to be in focus on Tuesday along with Powell's remarks

during a moderate discussion with De Nederlandsche Bank President Klaas Knot.

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

MARK LEIBOVIT - HOWE STREET 'THIS WEEK IN MONEY' PODCAST JUST POSTED - PLUS MORE ON THE SUN AND THE FED

https://www.howestreet.com/2024/05/gold-oil-dow-real-estate-mortgage-rates-evs-mark-leibovit-hilliard-macbeth-ross-clark-this-week-in-money/

Not new, but got to watch this clip regarding the FED and printing money

https://tinyurl.com/46nj8bsj

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.