News & Updates

LEIBOVIT VR NEWSLETTERS - MONDAY - APRIL 8, 2024 - THE DAY AMERICA LOOKED TO THE SKIES AND HOPES THE GROUND UNDER THEM DOES NOT TREMBLE

Courtesy Ray Merriman:

The path of eclipse totality will go right over Niagara Falls at 3:15 PM on Monday. Niagara Falls generates an enormous amount of hydropower and was once a Category 5 earthquake fault line. Additionally, the path of totality will crisscross a previous eclipse that happened in the U.S. in 2017 over southwest Missouri. The New Madrid fault line runs through that area. What does this mean? Well, first of all, understand that earthquakes do not always happen exactly on the day of the eclipse. They can be a few months off. However, in several cases, they occurred on the line of the eclipse path a few months later. Second, understand that there really isn’t too much you can do, for earthquakes are outside of one’s ability to control. You can have a plan to seek safety if one occurs. But you cannot pinpoint the exact time AND location when one will occur (although I am certain that if one does occur, someone will claim to have predicted it). It does very little good to fret over something you cannot control. Just be alert and have a plan if you are in a region (the eclipse path) that is vulnerable to any kind of natural calamity. But also know that if a calamity were to occur on the eclipse path, it could be several months after the moment of the eclipse.

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

THE BALTIMORE BRIDGE COLLAPSE MAY HAVE BEEN THE BEGINING. THE EFFECTS OF THE APRIL SOLAR ECLIPSE! SEISMIC RUMBLINGS 150 OFF THE COAST OF VANCOUVER ISLAND, THE TAIWAN EARTHQUAKE, EARTHQUAKE IN NEW YORK. AND, NOW AN POTENTIALLY EXPLOSIE IRAN/ISRAEL CONFRONTATION NOW UNDERWAY. MERCURY RETROGRADE BEGUN APRIL 1. NEW MOON AND THE SOLAR ECLIPSE ON APRIL 8.

THE DECEMBER 21-22 WINTER SOLSTICE DEFINED A MARKET TOPPING PROCESS AND NOW WE'RE FOCUSING IN ON THE VERNAL EQUINOX TO LIKELY PERFORM THE OPPOSITE - A LOW POINT IN THE MARKET

FOMC MEETINGS 2024

MAY 1

JUNE 12

JULY 31

SEPT 18

NOV 7

DEC 18

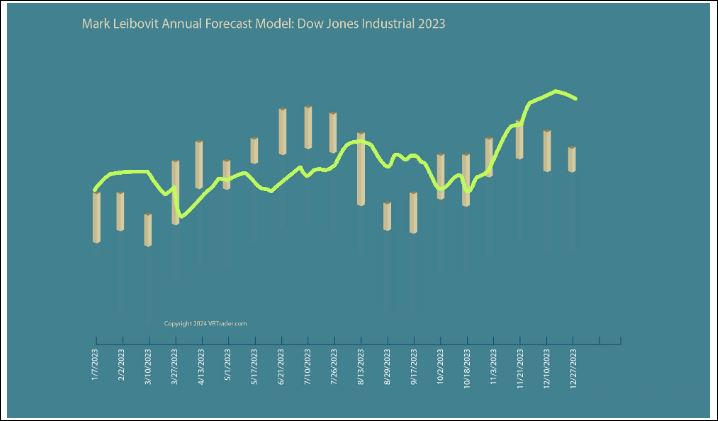

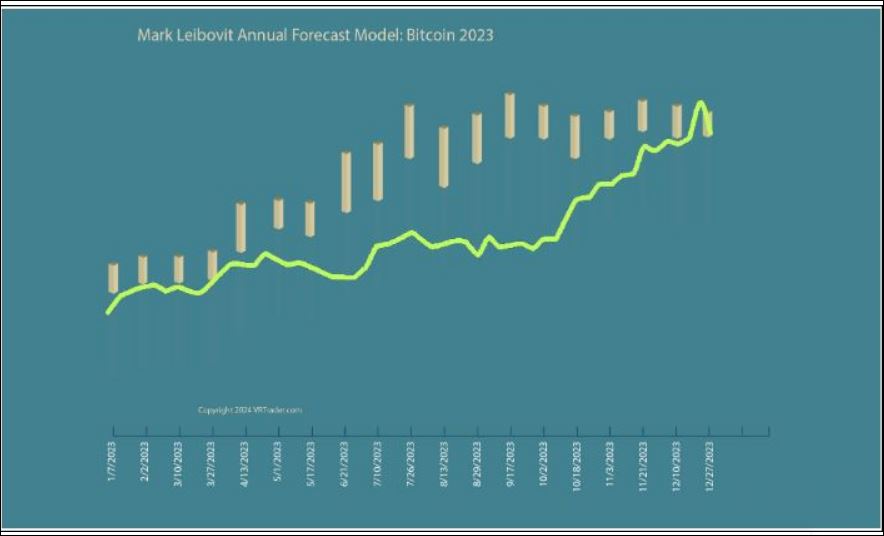

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

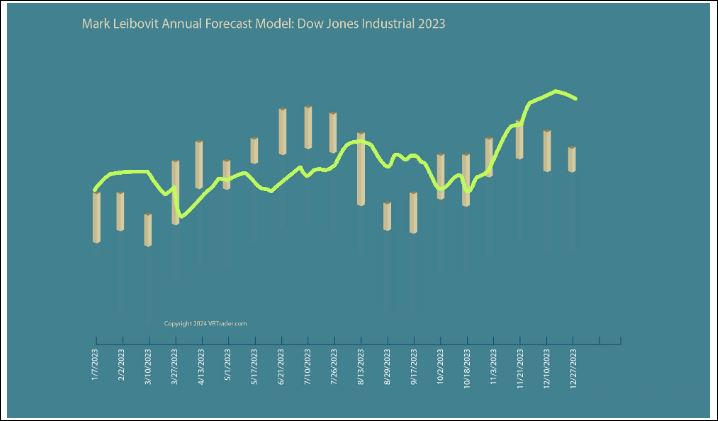

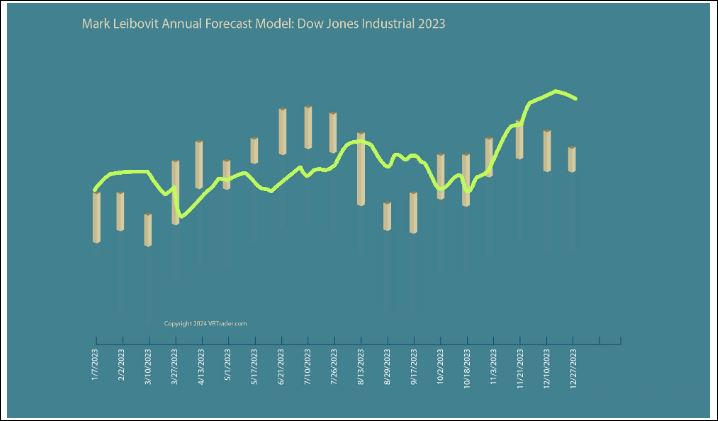

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

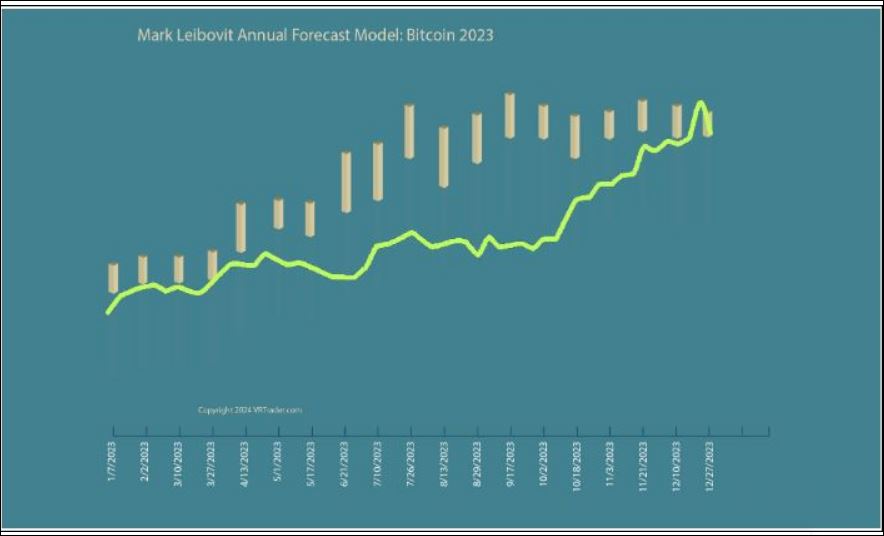

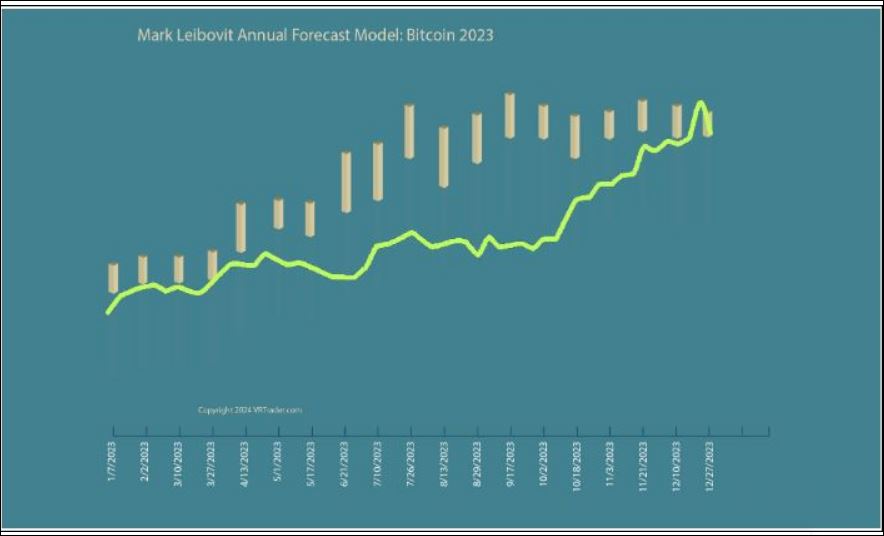

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

U.S. Stocks Show Significant Rebound Following Strong Jobs Data

Following the sell-off seen late in the previous session, stocks showed a significant move back to the upside during trading on Friday. The major averages all moved notably higher, largely offsetting Thursday's steep losses.

The major averages finished the day off their highs of the session but still firmly in positive territory. The Nasdaq surged 199.44 points or 1.2 percent to 16,248.52, the S&P 500 jumped 57.13 points or 1.1 percent to 5,204.34 and the Dow advanced 307.06 points or 0.8 percent to 38,904.04.

Despite the rebound on the day, the major averages all moved lower for the week. The Dow plunged by 2.3 percent, while the S&P 500 slumped by 1.0 percent and the Nasdaq slid by 0.8 percent.

The rebound on the day came as traders looked to pick up stocks at relatively reduced levels following the steep drop seen during Thursday's session, which dragged the Dow down to its lowest closing level in a month.

Traders also reacted positively to a closely watched Labor Department report showing much stronger than expected job growth in the month of March.

The Labor Department said non-farm payroll employment spiked by 303,000 jobs in March after surging by a downwardly revised 270,000 jobs in February.

Economists had expected employment to jump by 200,000 jobs compared to the addition of 275,000 jobs originally reported for the previous month.

The report also said the unemployment rate edged down to 3.8 percent in March from 3.9 percent in February, while economists had expected the unemployment rate to come in unchanged.

While the stronger than expected job growth may have added to recent concerns about the outlook for interest rates, the report also showed a continued slowdown in the annual rate of wage growth.

The Labor Department said the annual rate of wage growth slowed to 4.1 percent in March from 4.3 percent in February, in line with estimates.

"While wages are growing solidly, their growth rate has moderated to the least since mid-2021," said Bill Adams, Chief Economist for Comerica Bank. "The economy-wide slowdown in inflationary pressures is extending to labor costs."

"The Fed will be glad to see wage growth normalizing," he added. "This jobs report will make the Fed more confident that inflation is moderating; they say more confidence on this point is a precondition for making rate cuts this year."

Gold stocks moved sharply higher following the pullback seen on Thursday, driving the NYSE Arca Gold Bugs Index up by 3.3 percent to its best closing level in well over ten months.

The rebound by gold stocks came amid a substantial increase by the price of the precious metal, with gold for June delivery surging $36.90 to $2,345.40 an ounce.

Significant strength was also visible among retail stocks, as reflected by the 1.7 percent gain being posted by the Dow Jones U.S. Retail Index.

Software, semiconductor and housing stocks also saw considerable strength on the day, moving higher along with most of the other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly lower during trading on Friday. Japan's Nikkei 225 Index plunged by 2.0 percent, while South Korea's Kospi slumped by 1.0 percent.

The major European markets also moved to the downside on the day. While the U.K.'s FTSE 100 Index slid by 0.8 percent, the French CAC 40 Index and the German DAX Index tumbled by 1.1 percent and 1.2 percent, respectively.

In the bond market, treasuries regained some ground after an early sell-off but remained firmly negative. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, climbed 6.9 basis points to 4.378 percent.

Looking Ahead

Inflation data will move back into the spotlight next week, with the Labor Department due to release its reports on consumer and producer price inflation in the month of March.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

WELCOME TO LEIBOVIT VR NEWSLETTERS - FRIDAY - APRIL 5, 2024 - KEEP YOUR EYES TO SKIES!

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

It symbolizes power, good fortune, and strength and is associated with auspicious traits like intelligence, ambition and charisma. Historically linked with imperial power, Chinese emperors considered themselves descendants of dragons, emphasizing the dragon's esteemed position.

I HAVE BEEN PREDICTNG A BLACK SWAN - BALTIMORE MAY BE ONE OF MANY.

PERHAPS THE EFFECTS OF THE APRIL SOLAR ECLIPSE! SEISMIC RUMBLINGS 150 OFF THE COAST OF VANCOUVER ISLAND NOW UNDERWAY. MERCURY RETROGRADE BEGINS APRIL 1. NEW MOON AND THE SOLAR ECLIPSE ON APRIL 8.

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

U.S. Stocks Close Sharply Lower Following Late-Day Sell-Off

Stocks turned in a strong performance throughout much of the trading day on Thursday but came under substantial pressure in the latter part of the session. The major averages plummeted in the final two hours of trading, ending the day sharply lower.

The major averages saw continued weakness going into the close, finishing the session nearly their worst levels of the day. The Nasdaq tumbled 228.38 points or 1.4 percent to 16,049.08, while the S&P 500 slumped 64.28 points or 1.2 percent to 5,147.21.

After surging nearly 300 points in early trading, the Dow plunged 530.16 points or 1.4 percent to 38,596.98, closing lower for the fourth straight session.

The late-day sell-off on Wall Street came amid a continued surge by the price of crude oil, which advanced for the fifth straight session and reached its highest levels since last October.

Crude for May delivery jumped $1.16 to $86.59 a barrel, raising concerns higher energy prices will keep inflation elevated and convince the Federal Reserve to hold off on lowering interest rates.

Earlier in the session, stocks benefited from a positive reaction to a Labor Department report showing first-time claims for U.S. unemployment benefits rose by more than expected in the week ended March 30th.

The report said initial jobless claims climbed to 221,000, an increase of 9,000 from the previous week's revised level of 212,000.

Economists had expected jobless claims to inch up to 214,000 from the 210,000 originally reported for the previous week.

With the bigger than expected increase, jobless claims reached their highest level since hitting 225,000 in the week ended January 27th.

The advance by jobless claims generated some optimism about the outlook for interest rates, although the likelihood of a rate cut in June remains uncertain.

CME Group's FedWatch Tool is currently indicating a 63.1 percent chance the Federal Reserve will cut rates by a quarter point in June but a 29.4 percent chance rates will remain unchanged.

Sector News

Semiconductor stocks moved sharply lower over the course of the session, dragging the Philadelphia Semiconductor Index down by 3.0 percent.

Shares of AI darling Nvidia (NVDA) plunged by 3.4 percent after jumping as much as 1.9 percent early in the trading day.

Considerable weakness also emerged among housing stocks, as reflected by the 1.6 percent loss posted by the Philadelphia Housing Sector Index.

Gold stocks also saw significant weakness as the price of the precious metal snapped a seven-session winning streak, with the NYSE Arca Gold Bugs Index falling by 1.6 percent.

Computer hardware, brokerage and healthcare stocks also came under pressure as the day progressed, moving lower along with most of the other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher on Thursday, with markets in China and Hong Kong closed for a holiday. Japan's Nikkei 225 Index advanced by 0.8 percent, while South Korea's Kospi jumped by 1.3 percent.

Most European stocks also moved to the upside on the day. The U.K.'s FTSE 100 Index climbed by 0.5 percent and the German DAX Index rose by 0.2 percent, although the French CAC 40 Index closed just below the unchanged line.

In the bond market, treasuries fluctuated over the course of the session before closing firmly positive. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, slid 4.6 basis points to 4.309 percent.

Looking Ahead

Trading on Friday is likely to be driven by reaction to the monthly jobs report and its impact on the outlook for interest rates.

Economists currently expected employment to jump by 200,000 jobs in March after surging by 275,000 jobs in February, while the unemployment rate is expected to hold at 3.9 percent.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

WELCOME, IT'S THURSDAY, APRIL 4 AND YOUR READING LEIBOVIT VR NEWSLETTERS

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

It symbolizes power, good fortune, and strength and is associated with auspicious traits like intelligence, ambition and charisma. Historically linked with imperial power, Chinese emperors considered themselves descendants of dragons, emphasizing the dragon's esteemed position.

I HAVE BEEN PREDICTNG A BLACK SWAN - BALTIMORE MAY BE ONE OF MANY.

PERHAPS THE EFFECTS OF THE APRIL SOLAR ECLIPSE! SEISMIC RUMBLINGS 150 OFF THE COAST OF VANCOUVER ISLAND NOW UNDERWAY. MERCURY RETROGRADE BEGINS APRIL 1. NEW MOON AND THE SOLAR ECLIPSE ON APRIL 8.

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/03/achtung-baby-germans-about-to-legalize-pot-mark-leibovit/

NEXT PODCAST THURSDAY EVENING

Major Averages Fluctuate Before Closing Narrowly Mixed

Stocks recovered from an initial move to the downside and spent most of Wednesday's trading session in positive territory. Buying interest waned in the latter part of the session, however, with the major averages eventually ending the day narrowly mixed.

While the Dow edged down 43.10 points or 0.1 percent to 39,127.14, closing lower for the third consecutive session, the S&P 500 crept up 5.68 points or 0.1 percent to 5,211.49 and the Nasdaq rose 37.00 points or 0.2 percent to 16,277.46.

The early turnaround on Wall Street came following the release of a report from the Institute for Supply Management showing an unexpected slowdown in the pace of U.S. service sector growth in the month of March.

The ISM said its services PMI dipped to 51.4 in March from 52.6 in February. While a reading above 50 still indicates growth in the sector, economists had expected the index to inch up to 52.7.

Notably, the report also showed a substantial slowdown in the pace of price growth in the sector, with the prices index tumbling to 53.4 in March from 58.6 in February. The index fell to its lowest level since March 2020.

The data helped ease recent concerns about the outlook for interest rates, which contributed to a steep drop by stocks on Tuesday.

Worries the Federal Reserve may hold off on lowering interest rates also contributed to the early weakness on Wall Street after payroll processor ADP released a report this morning showing stronger than expected private sector job growth in the U.S. in the month of March.

ADP said private sector employment jumped by 184,000 jobs in March after climbing by an upwardly revised 155,000 jobs in February.

Economists had expected private sector employment to increase by 148,000 jobs compared to the addition of 140,000 jobs originally reported for the previous month.

Meanwhile, Fed Chair Jerome Powell reiterated during remarks at Stanford University that the central bank is not in a hurry to begin lowering interest rates.

Powell pointed to higher inflation data over January and February as a reason for the Fed to be cautious but acknowledged it is "too soon to say whether the recent readings represent more than just a bump."

"We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2 percent," Powell said.

He added, "Given the strength of the economy and progress on inflation so far, we have time to let the incoming data guide our decisions on policy."

The modest lower close by the Dow partly reflected steep drop by shares of Intel (INTC), with the semiconductor giant plunging by 8.2 percent.

Intel came under pressure after disclosing a $7 billion operating loss by its semiconductor manufacturing business in 2023, wider than the $5.2 billion operating loss the year before.

Sector News

Gold stocks saw significant strength on the day, driving the NYSE Arca Gold Bugs Index up by 2.3 percent to its best closing level in over ten months.

The rally by gold stocks came as the price of the precious metal jumped to a new record high, with gold for June delivery surging $33.20 to $2,315 an ounce.

Considerable strength was also visible among computer hardware stocks, as reflected by the 2.1 percent jump by the NYSE Arca Computer Hardware Index.

An increase by the price of crude oil also contributed to notable strength among energy stocks, while housing stocks also moved to the upside.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly lower during trading on Wednesday. Japan's Nikkei 225 Index slumped by 1.0 percent, while Hong Kong's Hang Seng Index tumbled by 1.2 percent.

Meanwhile, the major European markets moved to the upside on the day. While the German DAX Index climbed by 0.5 percent, the French CAC 40 Index rose by 0.3 percent and the U.K.'s FTSE 100 Index closed just above the unchanged line.

In the bond market, treasuries recovered from early weakness to end the day slightly higher. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, edged down by 1.0 basis point to 4.355 percent after reaching a high of 4.429 percent.

Looking Ahead

Reports on weekly jobless claims and the U.S. trade deficit may attract attention on Thursday, although trading activity is likely to be somewhat subdued ahead of the release of the more closely watched monthly jobs report on Friday.

US banking crisis of 2023 could easily happen again -Money Control

Could this year bring more bank failures as regulators fail to see all of the vulnerabilities modern banking brings? The reforms actually needed in the banking industry will take time and effort - two qualities in short supply in an election year.

by Bill Dudley

Ever since the demise of Silicon Valley Bank in March 2023, regulators have been focused primarily on increasing loss-absorbing capital at the largest US financial institutions. Much less attention has been paid to the problem that precipitated last spring's banking crisis: banks' vulnerability to sudden depositor withdrawals.

The SVB debacle exposed three weaknesses. First, depositors pulled their money much faster than assumed by requirements such as the liquidity coverage ratio, intended to ensure that banks have enough cash and easy-to-sell assets to survive 30 days of withdrawals. Second, the Federal Reserve couldn't provide sufficient emergency discount-window loans, because banks hadn't pledged enough collateral to the Fed. Third, uninsured depositors had ample reason to run, because they couldn't be sure the government would make them whole: Such bailouts can happen only after a bank fails and regulators judge that the situation is bad enough to invoke the "systemic risk exception."

What to do? Certainly, regulators need to recognise that depositor runs will be much faster, and outflow rates much higher, in an era of social media and 24-hour banking. Yet requiring banks to hold a lot more high-quality assets in response would be counterproductive. Tougher liquidity requirements would force banks to divert funds away from lending.

The Gold Investing Madness Is Just Getting Started -Forbes

Our main takeaway in this piece from Bob Haber, "I currently recommend seizing every opportunity to accumulate gold on dips and to allocate a suitable portion of one's portfolio to it."

by Bob Haber

It's that time of year again-the end of March Madness, a period when sports fans are fully immersed in the exhilarating action of the NCAA men's and women's playoff basketball games spanning several weeks. What unites sports enthusiasts during this period is the quest for an elusive perfect bracket. With more than tens of millions of Americans submitting brackets each year, anyone who has participated knows the exhilarating feeling of believing they've made perfect picks before the tournament begins. But as it usually goes, you get some predictions right, some wrong, all while glued to the screen, eagerly hoping every bounce of the ball favors your choices.

It's funny. The March Madness approach doesn't sound too different from how many investors approach the stock market.

But the analogy between the tournament and investing breaks down when it comes to asset allocation. Holding uncorrelated assets in a portfolio isn't a matter of luck; it's based on Nobel Prize-worthy mathematics. Recognizing when a major asset class is transitioning from a good diversifier to a potentially lucrative investment opportunity isn't about luck either. As I've highlighted in my previous pieces ( Gold Can't Be Downgraded and It's No One's Liability (forbes.com) and When The Gold Dust Settled (forbes.com), such is the case for Gold at present. What is fortunate, however, is the apparent lack of attention to this, which could also be construed as a bullish sign.

In March, Gold broke out of a nearly four-year range to reach new all-time highs above $2,200 per ounce. When Gold breaks out, many assume that geopolitical crises are driving the surge. However, there haven't been any recent significant shocks from conflicts in the Middle East or Europe, which are typically catalysts for such rapid increases in the price of the yellow metal.

The economic consequences of the calamity in Baltimore are likely to be substantial.

A Supply and Demand Shock

Economists call this a "supply shock," and it is likely to lead to a resurgence of goods inflation and possibly temporary shortages of some goods. The rerouting of shipping and subsequent congestion at other ports will mean that even goods that were never destined to come through Baltimore may be subject to delivery delays.

“This period of deflation in goods that we’ve been in for the last six months or so — we are probably coming out of that,” Citigroup economist Andrew Hollenhorst said in a Bloomberg TV interview on Tuesday.

There's also a "demand shock" component. Clearing the channel and rebuilding the bridge will take manpower, materials, and time that would have otherwise gone to other projects. Some of those will have to be put on hold. The additionaldemand will also fuel inflation, particularly in an economy already straining at full employment and near its productive capacity.

Baltimore is one of the largest ports on the eastern seaboard of the United States. It is the fifth largest port on the East Coast by total tons of cargo handled, according to the Bureau of Transportation Statistics, and the seventeenth largest overall in the United States.

Those numbers understate its importance to the U.S. economy. The port is the twelfth largest container port in the U.S., according to Ryan Peterson, the CEO of Flexport. It was ninth in terms of the tonnage and value of foreign cargo, according to the governor of Maryland.

It was the first in terms of the volume of automobiles and light trucks (including 847,158 cars and light trucks), heavy farm and construction machinery, imported sugar, and imported gypsum, the governor’s office said in a statement last year.

"Around the world, about 40 ships, including 34 cargo vessels, have Baltimore listed as a destination, including 10 commercial ships with anchors dropped in nearby waters, according to MarineTraffic, which tracks ships," the New York Times reported last Tuesday.

Baltimore's port is also the second largest terminal for coal exports, handling around 74 million tons of coal last year, according to Bloomberg.

"The collapse of a major Baltimore bridge is likely to shut down coal exports for as many as six weeks and block the transport of up to 2.5 million tons of coal, said Ernie Thrasher, chief executive officer of Xcoal Energy & Resources LLC," Bloomberg reported.

A Costly and Lengthy Recovery

The port is completely shut down in the wake of the collision of the Dali with the Key bridge and the near-total collapse of the bridge. It is likely to take weeks or even months to get the port back in working order given the position of the bridge. Perhaps portions the channel can be cleared more quickly but that is unclear at this time.

The Baltimore Field Office of the Federal Bureau of Investigation said in a press release that there is “no specific and credible information to suggest any ties to terrorism at this time.” United States Attorney for the District of Maryland Erek L. Barron also dispelled attack rumors.

Editor: This confirms it was terrorism!

Former U.S. Ambassador to Israel David Friedman lambasted the Biden administration and the Democratic Party over the refusal of the American mission to the United Nations to invoke the U.S. veto to block a Security Council resolution demanding an immediate ceasefire in the Gaza Strip.

Israeli Prime Minister Benjamin Netanyahu posted a tweet on the social media website X, Wednesday, expressing his sorrow at the passing of Joe Lieberman.

Lieberman was, as noted by The Washington Post, the first Jewish candidate on a national ticket for a major party in the U.S. when he ran as Al Gore's running mate.

"Sara and I grieve with Hadassah and the entire Lieberman family on the passing of our beloved Joe Lieberman," Netanyahu wrote, referring to Sara, his wife, and Hadassah, Joe's spouse, in the remarks.

Canada’s vibrant Vancouver Islands were shook by almost 2,000 tremors in a single day earlier this month. And some digging around the coast has revealed that this isn’t a cause for concern, rather a profound geological process that involves the birth of a new ocean floor in the area!

Earlier this month, the Endeavour site, located roughly 240 kilometres offshore and situated on the Juan de Fuca Ridge, experienced a remarkable earthquake swarm in a single day. Unlike the powerful earthquakes that can devastate coastal regions, these tremors were relatively small, registering mostly below a magnitude of one. "Mid-ocean ridges aren't actually capable of producing that large of earthquakes," Zoe Krauss, a doctoral candidate in marine geophysics at the University of Washington, explains.

What these tremors do reveal is the ongoing process of seafloor spreading. The Endeavour site sits on a mid-ocean ridge, where the Pacific and Juan de Fuca plates are slowly pulling apart. As these plates stretch, they can extend by about 3.3 feet (1 metre) before reaching a critical point. This stretching thins the Earth's crust, creating long fault lines and allowing molten rock (magma) from the mantle to rise up. Eventually, this magma cools and hardens, forming a new ocean floor.

The recent earthquake swarm suggests the seafloor at the Endeavour site may have reached its maximum stretch, triggering these small tremors. According to Krauss, the most likely scenario is that magma is now on its way up to fill the gaps and solidify, adding a new piece to the ocean floor.

This isn't the first time the Endeavour site has shown signs of increased seismic activity. Krauss points out that the region has become more active since 2018, with March 6th marking the peak of this recent swarm. The good news is that the activity has since calmed down, though it remains slightly more elevated than usual.

The Endeavour site is continuously monitored by the North-East Pacific Time-series Undersea Networked Experiments (NEPTUNE), a network run by Ocean Networks Canada. This ongoing monitoring provides scientists with invaluable data. While the continuous monitoring began in 2011, this is the first time researchers have had access to near real-time data of a magma intrusion event like this. This opens doors to a wealth of new information about the process of ocean floor formation.

For Krauss and her colleagues, the questions are plentiful. They're eager to understand the impact this event might have on the unique ecosystem surrounding the hydrothermal vents at the Endeavour site. Additionally, they're curious about the source of the magma that will ultimately form the new crust. These tiny tremors, far from being a cause for alarm, are a scientist's dream — a window into the dynamic processes that continuously reshape our planet.

Larry Fink Warns of ‘Snowballing Debt’ Hitting US Economy -Yahoo! Finance

BlackRock Inc. Chief Executive Officer Larry Fink said the US public debt situation “is more urgent than I can ever remember” and that the country needs to adopt policies to spur economic growth.

The nation can’t rely on taxes and spending cuts to get the problem under control, Fink wrote in his annual letter Tuesday. He raised the prospect of a “bad scenario” akin to Japan’s economy in the late 1990s and early 2000s, which led to a period of austerity and stagnation.

“A high-debt America would also be one where it’s much harder to fight inflation since monetary policymakers could not raise rates without dramatically adding to an already unsustainable debt-servicing bill,” said Fink, 71.

The cost of servicing the debt has already ballooned, and the 3 percentage points in extra interest payments the US government now must pay on 10-year Treasuries compared with three years ago is “very dangerous,” he wrote.

“More leaders should pay attention to America’s snowballing debt,” Fink wrote, saying the US can’t take for granted that investors will continue to want to buy as much US debt. Foreign countries are building their own capital markets and are likely to invest domestically, he said

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]