News & Updates

LEIBOVIT VR NEWSLETTERS - THURSDAY - APRIL 11, 2024 - DID YOU ENJOY WEIRD WOLLIE WEDNESDAY?

WEIRD WOLLIE:

The term was invented by market analyst, Don Wolunchuk. Weird Wally is most likely caused by the fact that most futures have "rollover" dates on the Wednesday/Thursday the week before expiration. The quarterly Weird Wallies (March, June, September, December) will see more volatility since many futures are quarterly (such as the widely traded S&P e-mini) and not monthly. Weird Wally is not really an options phenomenon, but it does affect options and options traders because many futures traders hedge with options and will close those options positions when they rollover/close their futures positions. As I've said, Weird Wally Wednesday and sometimes the day after tend to be down days. In bull markets, it tends to set up a buying opportunity ahead of the following week's options expiration. Let's see if we get a pullback here. If so, it would fit nicely to set up further strength next week.

The liberal media is outraged at President Trump. AGAIN.

Trump pointed out that Jews who vote Democrat are voting against their own self-interest- and it makes no sense. That’s like the police chief in Casablanca being shocked there’s gambling in that casino!

https://tinyurl.com/3eepxj2a

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

MORE BLACK SWANS ARE UNDERWAY

THE DECEMBER 21-22 WINTER SOLSTICE DEFINED A MARKET TOPPING PROCESS AND NOW WE'RE FOCUSING IN ON THE VERNAL EQUINOX WHICH IN HINDSGHT WAS COINCIDENT WITH ANOTHER MARKET PEAK.

FOMC MEETINGS 2024

MAY 1

JUNE 12

JULY 31

SEPT 18

NOV 7

DEC 18

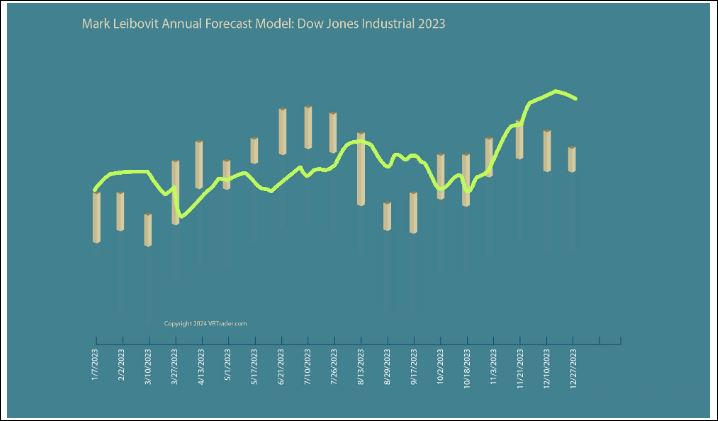

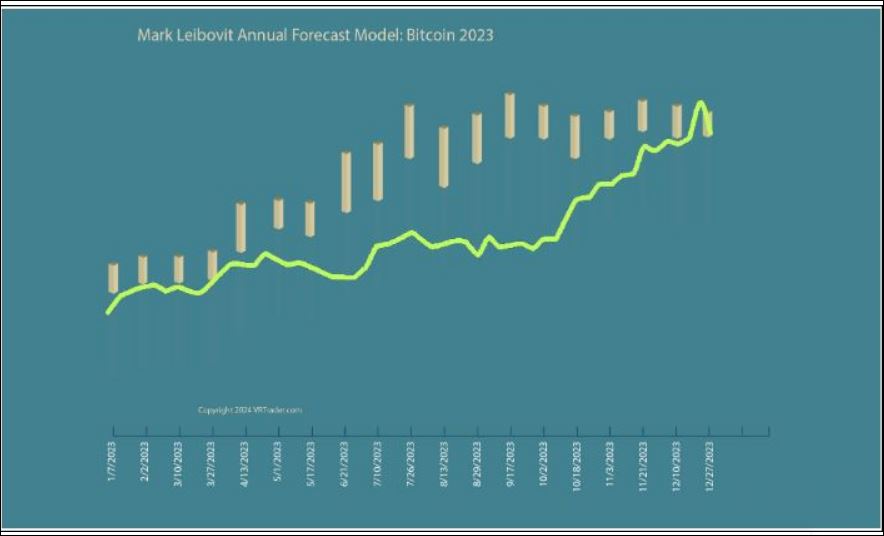

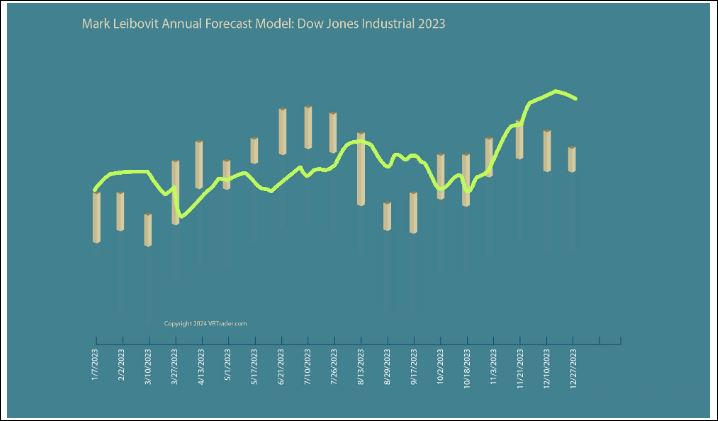

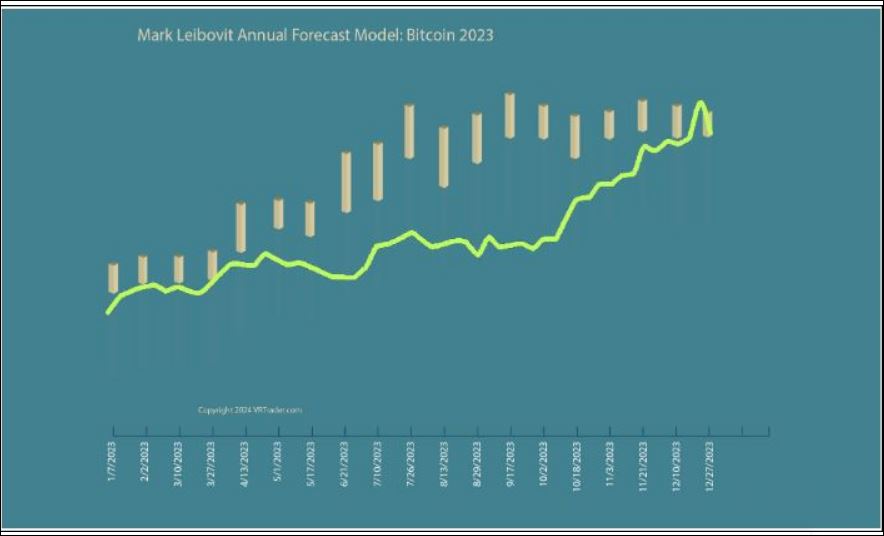

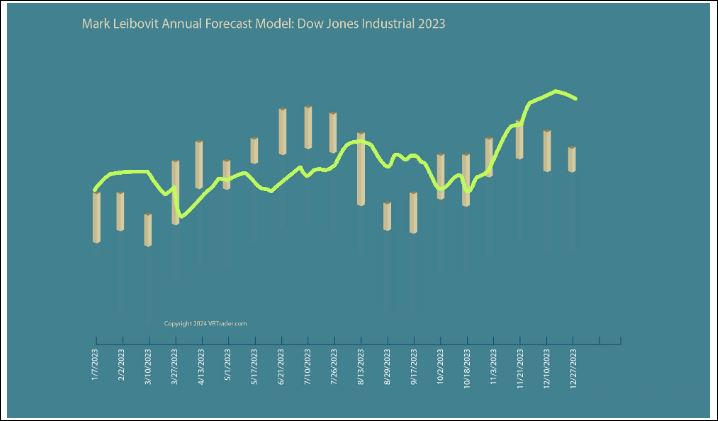

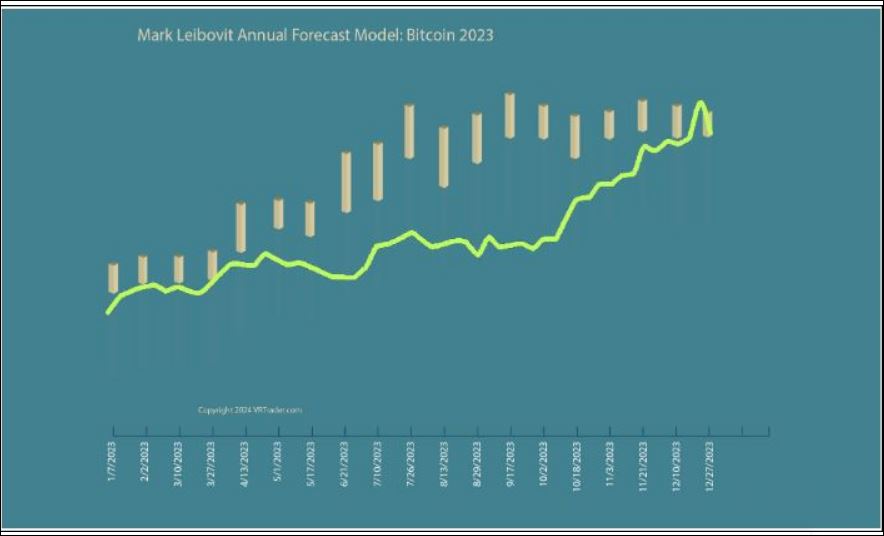

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

NEXT PODCAST - THURSDAY EVENING

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

REPORTED YESTERDAY: THE PRESS IS NOT REPORTING THAT RAPHAEL BOSTIC, THE HEAD OF THE FEDERAL RESERVE OF ATLANTA LEAKED A STORY ON TUESDAY THAT RATE CUTS COULD BE MOVED UP IF THE PACE OF DISINFLATION CONTINUES. THIS THE PLUNGE PROTECTION AT WORK, FOLKS! WAS THIS ARRANGED TO ALLOW TRADERS TO GET SHORT AHEAD OF WEIRD WOLLIE WEDNESDAY?

U.S. Stocks Plunge As Inflation Data Reignites Interest Rate Worries

Stocks moved sharply lower in early trading on Wednesday and continued to see significant weakness throughout the session. The major averages all showed notable moves to the downside, with the Dow falling to its lowest closing level in almost two months.

The major averages remained firmly negative going into the close of trading. The Dow tumbled 422.16 points or 1.1 percent to 38,461.51, the Nasdaq slid 136.28 points or 0.8 percent to 16,170.36 and the S&P 500 slumped 49.27 points or 1.0 percent to 5,160.64.

The early sell-off on Wall Street came following the release of a Labor Department report showing U.S. consumer prices advanced by slightly more than expected in the month of March.

The Labor Department said consumer prices climbed by 0.4 percent in March, matching the increase seen in February. Economists had expected consumer prices to rise by 0.3 percent.

Excluding prices for food and energy, core consumer prices still rose by 0.4 percent for the third consecutive month. Core consumer prices were also expected to increase by 0.3 percent.

The report also said the annual rate of consumer price growth accelerated to 3.5 percent in March from 3.2 percent in February. Economists had expected a more modest acceleration to 3.4 percent.

Meanwhile, the annual rate of core consumer price growth came in at 3.8 percent in March, unchanged from February. Core price growth was expected to slow to 3.7 percent.

The data added to recent worries the Federal Reserve will hold off on lowering interest rates amid ongoing inflation concerns. Fed officials have repeatedly said they need greater confidence inflation is slowing before they consider cutting rates.

Treasury yields surged in reaction to the report, with the yield on the benchmark ten-year note spiking above 4.50 percent for the first time since mid-November.

Following the release of the data, the chances of a rate cut in June have plunged to just 16.5 percent, according to CME Group's FedWatch Tool.

The minutes of the central bank's latest monetary policy meeting, released later in the day, revealed Fed officials were already not convinced inflation is moving sustainably down to 2 percent after January and February readings on core and headline inflation had been firmer than expected.

"The last mile for inflation down to the Fed target of 12-month core PCE at 2.00% has stalled recently at 2.80%," said Larry Tentarelli, President and Founder, Blue Chip Daily Trend Report. "That being said, unless inflation breaks out meaningfully to the upside, we do expect a Fed rate cut by the July 2024 meeting."

"In our view, however, this could be more of a token rate cut, and it is possible that it could be the only rate cut for 2024," he added. "Incoming inflation data and jobs data will remain as key factors."

Interest rate-sensitive housing and commercial real estate stocks turned in some of the worst performances on the day, with the Philadelphia Housing Sector Index and the Dow Jones U.S. Real Estate Index plunging by 4.3 percent and 4.1 percent, respectively.

Substantial weakness also emerged among airline stocks, as reflected by the 3.5 percent nosedive by the NYSE Arca Airline Index.

Shares of Delta Air Lines (DAL) tumbled by 2.3 percent despite the airline reporting better than expected first quarter earnings and predicting strong summer travel demand.

Banking stocks also moved sharply lower over the course of the session, dragging the KBW Bank Index down by 3.0 percent.

Networking, telecom and utilities stocks also saw considerable weakness on the day, moving lower along with most of the other major sectors.

Energy stocks were among the few groups to buck the downtrend, moving modestly higher as the price of crude oil jumped amid geopolitical concerns.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in another mixed performance during trading on Wednesday. Japan's Nikkei 225 Index fell by 0.5 percent, while Hong Kong's Hang Seng Index surged by 1.9 percent.

The major European markets also ended the day mixed after seeing strength earlier in the session. While the French CAC 40 Index edge down by 0.1 percent, the German DAX Index crept up by 0.1 percent and the U.K.'s FTSE 100 Index rose by 0.3 percent.

In the bond market, treasuries moved sharply lower in reaction to the hotter-than-expected inflation data. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, soared 19.4 basis points to 4.560 percent.

Looking Ahead

Additional inflation data may impact trading on Thursday, as the Labor Department is due to release its report on producer price inflation in the month of March.

The President's Working Group on Financial Markets

known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

Bill Murphy: 25 years of fighting the gold cartel

Remarks by Bill Murphy, Chairman

Gold Anti-Trust Action Committee Inc.

New Orleans Investment Conference

Hilton Riverside Hotel, New Orleans

Wednesday, November 1, 2023

In 1997 I came to this conference with my friend Frank Veneroso to present a copy of this "Gold Book" to its publisher, Jim Blanchard, the promoter of this conference before Brien Lundin took over.

A main feature of the book was that Frank learned through his sources, including The Bank of England, that various banks were leasing out their gold, to the tune of up to 8,000 tonnes.

In the fall of 1998 a legendary hedge fund, Long Term Capital Management blew up and had to exit all markets, including a supposed 400 tonnes of leased gold they had borrowed from various banks. I had just began my own daily commentary and noticed the same banks were stopping gold from blowing through $300 an ounce to the upside.

Over and over again the same thing, as it appeared these banks were covering for LTCM, whose lawyer was the famed Jim Rickards, and I began complaining about it every day. A new subscriber to my column, Chris Powell, tired of my rants, suggested we do something about it. Over the months ahead The Gold Anti-Trust Action Committee was formed.

That name has a bit of irony attached to it as many out there call us a conspiracy organ ization. With so much talk about conspiracies these days, that rant-like criticism of us stands out because GATA is just the opposite, as per the anti-trust aspect in our name. Trusts are groups which privately band together to secretly control prices or

markets. GATA came into being to expose these types of operations, not become one.

Right off the bat my partner Chris Powell demanded we DO something about the blatant gold price suppression operations, not just complain. Over the first half of the last 25 years, that is just what we did. For example:

-- From 2001 to 2011 we held 4 international conferences -- in Durban, South Africa; Dawson City up in Canada; Washington D.C; and in London.

-- Went to the authorities in Washington numerous times to see what we could do. That included seeing James Saxton, Chairman of The Joint Economic Committee; Congressman Ron Paul; James Hastert, speaker of the House, who hastily set up a meeting that afternoon with Sp encer Bacchus, chairman of the Subcommittee on Domestic and International Monetary Policy; and Bart Chilton, Commissioner of the CFTC, among others.

-- We spoke at a well attended gathering in D.C. was televised by C- Span.

-- And GATA returned to the nations capital to make a presentation at an internet televised CFTC investigation event.

There was a lot more and it was all about exposing what I call The Gold Cartel, which includes some major US banks, various central banks, The Bank for International

Settlements, and the US Government, including the Fed and Treasury. THEY were the conspiracy bonded together to suppress the gold price, and we have been out there to expose this conspiracy all this time.

As you can tell, over the first half of our 25 years in existence we were quite active in the public arena, which was topped off in that fabulous year of 2011 with our highly

regarded conference in London, England in early August. Silver had soared to $ 50 in early May of that year and then began to correct. Gold popped to $1650 during our

conference, as predicted by one of our speakers, the legendary Jim Sinclair, who recently passed away and then spiked to $1920 a month later.

Thus, GATAs first half of our 25-year effort to expose and take down the cabal forces essentially ended with been there, done that.

The last half of our existence, and effort to expose The Gold Cartel, has been a different trip of sorts. Much of that has had to do with dealing with the price suppression

efforts by the cabal forces via our commentaries. Over that time, the last 12 years, the price of gold has exceeded $2,000 an ounce three times, only to be shoved back down by THEM each time. Physical buying by Asian central banks provided much of the oomph to keep the gold price elevated. It has held up very well, constantly coming back from

orchestrated setbacks.

However, silver and the gold shares have been a totally d ifferent story. Gold share index, the HUI, rose to 622 in 2011, along with the gold price spike. It has been most

unpleasant since, recently spending time below 200, after all these years. And the junior mining shares have been a nightmare, to put it mildly.

While the price of gold has held its own, rising mining costs, alternative investment opportunities and Gold Cartel suppression have devastated the share market since its 2011 heyday.

And golds sidekick, silver, a focus of mine, has been a disaster, courtesy of JP Morgan. Thanks to these bums, investing in silver over the past decade has been something of a horror show. So, here is my take on what has occurred.

JP Morgan set up the silver price move to $50 in 2011. The silver open interest on the Comex, which represents the total number of silver long and short positions, remained at a very low 135,000 contracts all the way up until the last month of the move. Then the open interest numbers began to reall y rise once silver took out $35 on the upside.

During the move to $35 or so, it was JP Morgan buying all the physical silver they could get their hands on. With buyers searching for not be found silver, the price kept going up and up. JPM then began to sell the paper market in April of 2011 on the Comex, as the open interest began to rise. And JP Morgan has used the physical silver they bought over the past 12 years to facilitate their paper selling on the Comex ever since, wiping out spec long silver investors time and time again. Just recently, after all this time, the price of silver was trading at less than $22 per ounce.

It should be noted that in September 2020 JPMorgan admitted to committing wire fraud in connection with: (1) unlawful trading in the markets for precious metals futures contra

Over the past decade plus the cartel forces have gone all out to keep the precious metals under control and not let them reflect mounting inflation, money printing, and deficit spending in the US. Chris Powell and myself have also gone all out ourselves in our commentaries to point out what has been going on. Getting someone to seriously listen has been another matter.

Unfortunately, the financial media does not want to touch the subject with a ten foot pole. They have also facilitated the blatant price suppression via their silence, no

matter how obvious it gets. At the same time the gold/silver industry remains silent also, in total fear of upsetting their own financiers.

During this time, my colleague Chris Powell has done an outstanding job of handling the details of the GATA operations.

Meanwhile, Chris and I continue to do what we can to point out the obvious about manipulation of the precious metals via our commentaries, etc.

And that leads to what I hope gains day lighs to come over what GATA has worked on and put forth in the public domain over the last 12 years, much less the first 12 .

My expectation is for the price of gold and silver to soar in the near future. My reasoning is simple. That THEY will run out of enough physical supply to carry on like they have. FINALLY!

As the next few years plus plays out, the cabals dwindling physical supplies should lead to gold and silver price explosions. Once gold takes out its triple top of the past

years, it should go bonkers. Pitiful silver, as I have been calling it, unfortunately, for years, has to take out $30 to shoot for $50 for the third time in its history. Once

that level is exceeded, there is no telling how high its price c ould go.

In that regard, it is my opinion that Newtons Law of Equal and Opposite Reactions will take hold and kick in meaning as lousy as silver has traded these past years, it will trade equally that well once $30 is taken out. We shall see.

As a result of what The Gold Cartel has done over the past decade or so, investors have fled the gold share scene, and the silver market, like no time in history. Just

recently, the price of silver rose more than $2.50 per ounce and nearly $3 per ounce off a recent low, yet the silver open interest remained at only a little above 127,000

contracts. No interest for it in the public investing domain.

So where do we go from here after 25 years of being on the price suppression case?

As mentioned, my bet is the Gold Cartel will simply run out of enough physical supply to carry on like they have in the paper gold/silver markets.

The reasons for their prices to explode just become more blatant month afte r month. Investors, which had fled the gold, silver, share markets will return with a vengeance and this time the cabal forces will be unable to prevent all their prices from soaring.

Yes, Newtons Law will take over and the bums will be done for. At this time, those ignoring what GATA has been telling them for over two decades will register on their

scoreboards and will take hold as the truth about the bad guys will gradually surface, even if grudgingly.

Whether discussed, or admitted, in public commentary it will be clear the prices of gold and silver are going to where they should have years ago and that something unnatural was holding them back. As this is occurring, The Gold Cartel will be forced to backpedal and then backpedal again and again.

Couldn't happen to a nicer group!

And speaking of just that: The price of gold exploded late last Friday afternoon some $20 in a half hour, to blow through $2,000 an ounce. The reason was the visuals o f an Israeli ground invasion of Gaza were gutting the media.

There is no telling what sort of international chaos this is leading to, but wars of all sorts come to mind. Investing more and more in gold and silver will become paramount and they will suddenly soar as never before in history. The Gold Cartel/JP Morgan forces have not, and are not, prepared for what is in the process of occurring. The recent chaotic developments in the Middle East have caught them off guard in terms of dealing with physical demand.

At the same time, we are likely to see some growing civil unrest in the US early next year due to political differences that we have not dealt with for around 150 years. This could have a profound negative effect on the dollar and be a big boost for the precious metals.

In my opinion, as this all plays out, gold/silver share investments, which are ridiculously undervalued and cheap today, will go berserk.

If you are on board, next year will be full of smiles.

https://tinyurl.com/2rd9wv52

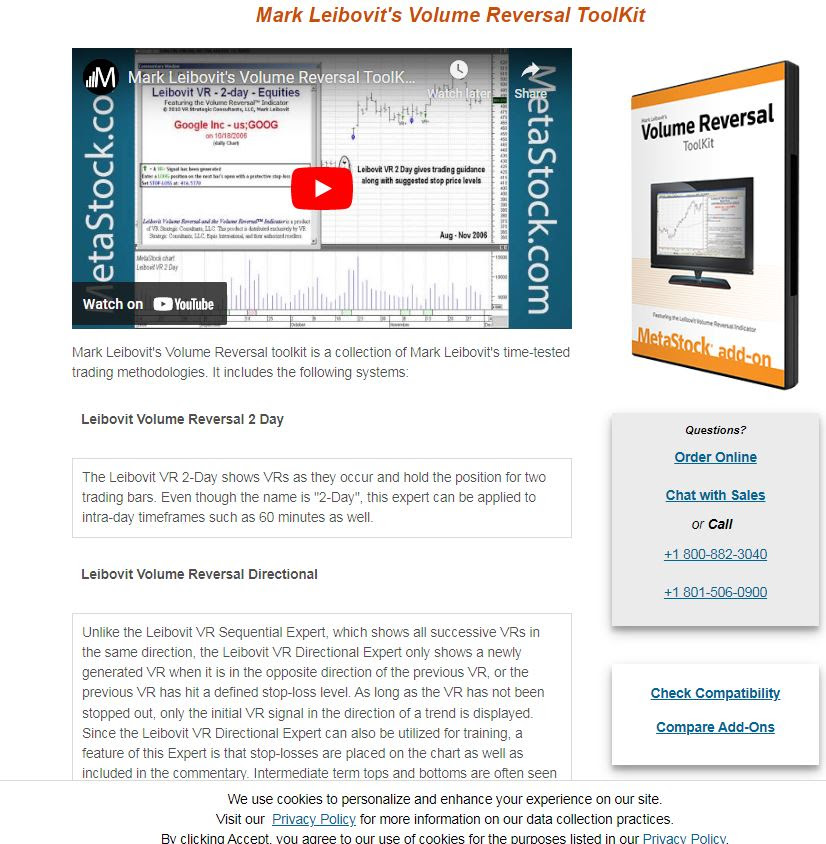

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

https://www.spaceweather.com/

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - WEIRD WOLLIE WEDNESDAY FOLLOWING 'TURNAROUND TUESDAY' - NOTE THE ATLANTA FED CHIEF FEEDS THE MARKET BULLISH COMMENTARY - APRIL 10, 2024

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

MORE BLACK SWANS ARE UNDERWAY

THE DECEMBER 21-22 WINTER SOLSTICE DEFINED A MARKET TOPPING PROCESS AND NOW WE'RE FOCUSING IN ON THE VERNAL EQUINOX WHICH IN HINDSGHT WAS COINCIDENT WITH ANOTHER MARKET PEAK.

FOMC MEETINGS 2024

MAY 1

JUNE 12

JULY 31

SEPT 18

NOV 7

DEC 18

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

NEXT PODCAST - THURSDAY EVENING

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

Following the lackluster performance seen on Monday, stocks saw considerable volatility over the course of the trading session on Tuesday. The major averages fluctuated as the day progressed, with the Nasdaq and the S&P 500 eventually closing in positive territory.

THE PRESS IS NOT REPORTING THAT RAPHAEL BOSTIC, THE HEAD OF THE FEDERAL RESERVE OF ATLANTA LEAKED A STORY THAT RATE CUTS COULD BE MOVED UP IF THE PACE OF DISINFLATION CONTINUES. THIS THE PLUNGE PROTECTION AT WORK, FOLKS!

While the Nasdaq rose 52.68 points or 0.3 percent to 16,306.64 and the S&P 500 inched up 7.52 points or 0.1 percent to 5,209.91, the narrower Dow ended the day slightly lower, edging down 9.13 points or less than a tenth of a percent to 38,883.67.

The volatility on Wall Street came as traders continued to look ahead to the release of the Labor Department's report on consumer price inflation on Wednesday.

Economists currently expect consumer prices to rise by 0.3 percent in March following a 0.4 percent increase in February.

Core consumer prices, which exclude food and energy prices, are also expected to climb by 0.3 percent in March after rising by 0.4 percent in February.

The annual rate of consumer price growth is expected to accelerate to 3.4 percent in March from 3.2 percent in February, while the annual rate of core consumer price growth is expected to slow to 3.7 percent for 3.8 percent.

The inflation data could have a significant impact on the outlook for interest rates, as Federal Reserve officials have repeatedly said they need greater confidence inflation is slowing before cutting rates.

Wednesday will also see the release of the minutes of the Fed's latest monetary policy meeting, which could also shed additional light on officials' thinking on rates.

"The central bank wants to see sustained evidence of inflation coming down and that doesn't appear to be on the menu," said Dan Coatsworth, investment analyst at AJ Bell.

"The signs are clear for investors to see, but many have been choosing to ignore them," he added. "The Fed putting it into black and white could be a difficult pill for investors to swallow, so brace yourself for turbulence on the market this week."

Sector News

Gold stocks showed a significant rebound following the pullback seen on Monday, driving the NYSE Arca Gold Bugs Index up by 1.9 percent to a nearly eleven-month closing high.

The strength among gold stocks came amid an increase by the price of the precious metal, which climbed to a new record high.

Considerable strength also emerged among biotechnology stocks, as reflected by the 1.6 percent gain posted by the NYSE Arca Biotechnology Index.

Networking, commercial real estate and telecom stocks also showed notable moves to the upside, while energy stocks saw some weakness amid a steep drop by the price of crude oil.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Tuesday. Japan's Nikkei 225 Index jumped by 1.1 percent, while South Korea's Kospi fell by 0.5 percent.

Meanwhile, the major European markets all moved to the downside on the day. While the German DAX Index tumbled by 1.3 percent, the French CAC 40 Index slumped by 0.9 percent and the U.K.'s FTSE 100 Index edged down by 0.1 percent.

In the bond market, treasuries regained ground after moving notably lower over the two previous sessions. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, is down by 5.6 basis points at 4.368 percent.

Looking Ahead

Early trading on Wednesday is likely to be driven by reaction to the consumer price inflation data, while the Fed minutes may attract attention later in the day.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

https://www.spaceweather.com/

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - 'TURNAROUND TUESDAY' - APRIL 9, 2024

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

BULL TRAP STILL UNDERWAY

BLACK SWANS ARE UNDERWAY

Just as the solar eclipse arrives, scientists are now admitting they recently (and covertly) launched a geoengineering experiment in San Francisco that aims to darken the skies by launching salt pollutants into the atmosphere. While the corporate media mocks Tennessee for passing anti-chemtrails legislation by claiming geoengineering is a "conspiracy theory," scientists in San Francisco are actively pursuing geoengineering experiments that would, if scaled up, absolutely devastate plants and crops across the planet.

THE DECEMBER 21-22 WINTER SOLSTICE DEFINED A MARKET TOPPING PROCESS AND NOW WE'RE FOCUSING IN ON THE VERNAL EQUINOX WHICH IN HINDSGHT WAS COINCIDENT WITH ANOTHER MARKET PEAK.

FOMC MEETINGS 2024

MAY 1

JUNE 12

JULY 31

SEPT 18

NOV 7

DEC 18

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/current-market-correction-was-predicted-mark-leibovit/

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

Following the substantial volatility seen over the final two sessions of the previous week, stocks turned in a relatively lackluster performance during trading on Monday. The major averages spent the day bouncing back and forth across the unchanged line before eventually closing narrowly mixed.

While the Nasdaq crept up 5.44 points or less than a tenth of a percent to 16,253.96, the Dow edged down 11.24 points or less than a tenth of a percent to 38,892.80 and the S&P 500 slipped 1.95 points or less than a tenth of a percent to 5,202.39.

The choppy trading on the day came as traders seemed reluctant to make significant moves ahead of the release of closely watched inflation data later in the week.

Some investors may also have been away from their desks as they traveled to other parts of the country to get a better view of today's total solar eclipse.

The Labor Department is scheduled to release its reports on consumer and producer inflation in the month of March on Wednesday and Thursday, respectively.

Economists currently expect consumer prices to rise by 0.3 percent in March following a 0.4 percent increase in February.

Core consumer prices, which exclude food and energy prices, are also expected to climb by 0.3 percent in March after rising by 0.4 percent in February.

The annual rate of consumer price growth is expected to accelerate to 3.4 percent in March from 3.2 percent in February, while the annual rate of core consumer price growth is expected to slow to 3.7 percent for 3.8 percent.

Producer prices are expected to rise by 0.3 percent in March after climbing by 0.6 percent in February, while the annual rate of producer growth is expected to jump to 2.3 percent from 1.6 percent.

The inflation data could have a significant impact on the outlook for interest rates, as Federal Reserve officials have repeatedly said they need greater confidence inflation is slowing before cutting rates.

Wednesday will also see the release of the minutes of the Fed's latest monetary policy meeting, which could also shed additional light on officials' thinking on rates.

Sector News

Most of the major sectors ended the day showing only modest moves, contributing to the lackluster close by the broader markets.

Airline stocks showed a strong move to the upside, however, with the NYSE Arca Airline Index jumping by 1.8 percent.

Significant strength was also visible among steel stocks, as reflected by the 1.8 percent gain posted y the NYSE Arca Steel Index.

Banking stocks also turned in a strong performance on the day, while gold stocks gave back ground following recent strength.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher on Monday. Japan's Nikkei 225 Index jumped by 0.9 percent and Hong Kong's Hang Seng Index inched up by 0.1 percent, although China's Shanghai Composite

Index bucked the uptrend and slid by 0.7 percent.

The major European markets also moved to the upside on the day. While German DAX Index advanced by 0.8 percent, the French CAC 40 Index climbed by 0.7 percent and the U.K.'s FTSE 100 Index rose by 0.4 percent.

In the bond market, treasuries extended the notable downward move seen last Friday. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, climbed 4.6 basis points to 4.424 percent.

Looking Ahead

A lack of major U.S. economic data may lead to another choppy trading session on Tuesday ahead of the inflation data due later this week.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]